Tax Co-Sourcing Insights

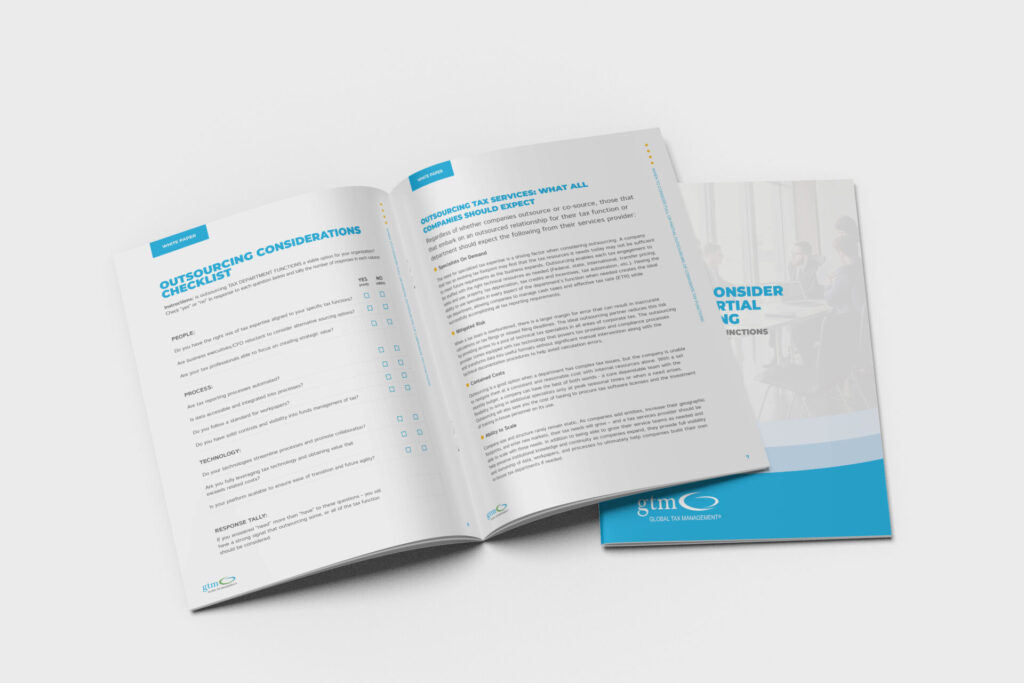

White Paper: When to Consider Full or Partial Outsourcing of Corporate Tax Functions

Outsourcing tax functions, whether fully or partially, offers companies access to the right people, process, and technology to comprehensively address operational tax functions and reduce…

October 16, 2023

Webinar: International Tax Traps and Opportunities in 2023

In this one-hour webinar, GTM’s International Tax Services team reviews a number of key international corporate tax issues which taxpayers should plan to address in…

April 20, 2023

Webinar: ASC 740 Interim Provision: Applying the Fundamentals

In this one-hour webinar, GTM Training Institute Practice Leader Frank Nieves, Curriculum Developer & Lead Instructor Joanne Tempone, and Director Gergana Lipidakova explain how ASC…

March 30, 2023

Webinar: Deploying a Tax Technology Strategy for the Modern Tax Department

In this one-hour webinar, GTM’s Anthony Sorrentino and Ron Shackelford will walk attendees through the process of deploying a tax technology strategy that empowers your…

March 2, 2023