Mountain or Molehill? Keeping Tax Policy Change in Perspective

By Raymond Wynman and Andrew Wai

With the recent passage of proposed legislation in both the House and the Senate, U.S. tax reform is finally becoming clearer. What can your tax department be doing in the near term to quantify the impact and identify tax planning opportunities and issues?

We suggest the following practical steps, which should ideally be completed before the effective date of enactment:

- Run your tax data through a U.S. Tax Reform Model to understand the impact of one-time repatriation and future tax position on cash taxes, ETR, and other tax attributes.

- Review E&P and other necessary data and determine if an E&P study is necessary.

Once the results of likely tax proposals are understood, then you should proceed with:

- Tax planning to minimize exposure to new taxes, preserve favorable tax attributes, and take advantage of lower rates.

- Consideration of other aspects, such as: ASC740 impact, required spreadsheet and software development or modification, and additional tax provision and tax compliance automation (after enactment of tax reform).

In this blog, we will run through some of the tax accounting considerations related to tax reform and provide tips on the tax modeling process.

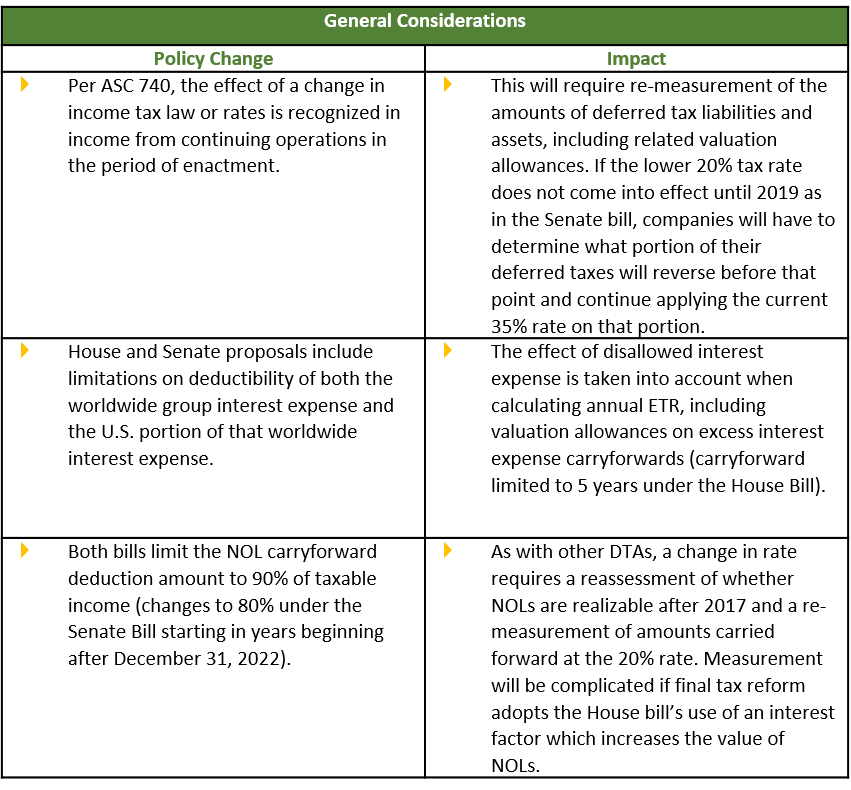

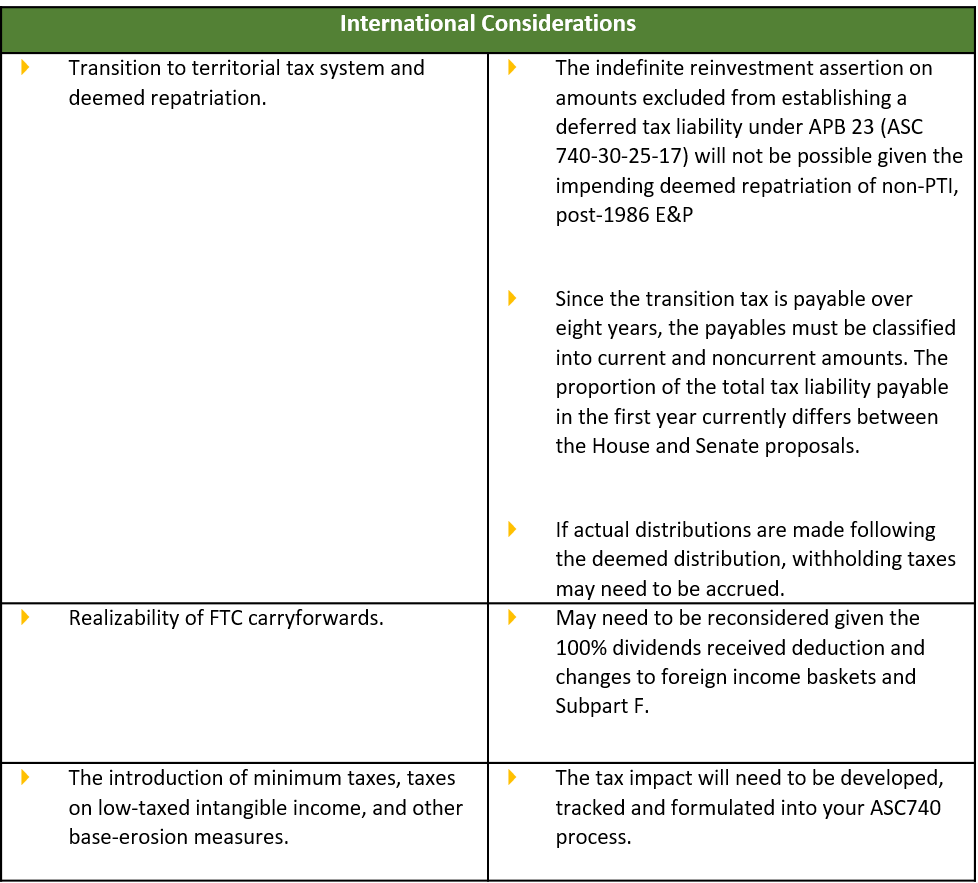

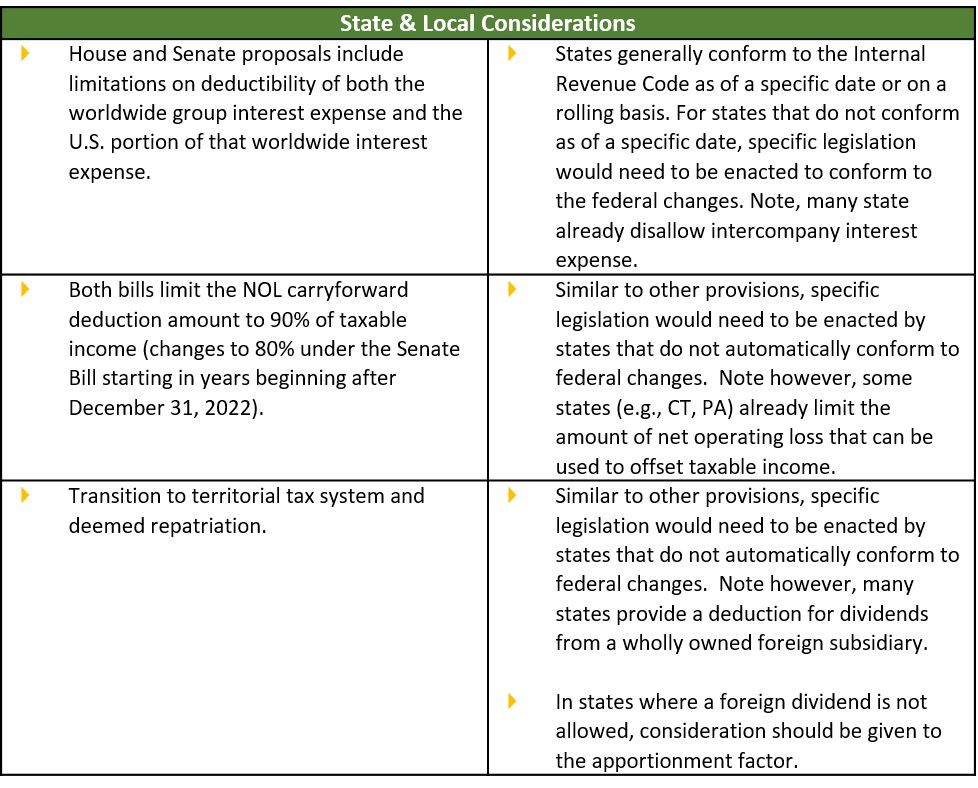

Tax Accounting Considerations

Looking ahead to the close of FY 2017, tax reform will pose some tax accounting issues which need to be considered in the provision process:

The attempt to transition from a worldwide to a territorial system of taxation while preventing base erosion has resulted in new proposed taxes on deemed repatriation, low-taxed intangible income, and payments to foreign related companies. For many multinational groups with complex structures and tax attributes, application of the proposed rules may produce counter-intuitive results.

Tax Reform Modeling

For example, attempting to estimate the tax liability resulting from deemed repatriation by taking total foreign E&P and multiplying by 10–14% (to the extent of cash and cash equivalents) or 5–7% (illiquid assets), as is commonly described in the business press, gives the wrong answer in many cases. The mechanism as laid out in the House’s H.R. 1 Section 4004 (corresponding with Section 14103 of the Senate bill) is roughly as follows:

- For the tax year beginning before January 1, 2018, the subpart F income of the CFC is increased by accumulated post-86 deferred foreign income.

- This amount is reduced by the allocated share of the U.S. shareholder’s aggregate E&P deficit and,

- the applicable share of the group aggregate unused E&P deficit.

- The U.S. shareholder receives a dividend received deduction which reduces the income inclusion to an effective tax rate of 14% of the shareholder’s aggregate foreign cash position plus 7% of the excess of the gross income inclusion over aggregate foreign cash.

The aggregate foreign cash position is the average of the foreign cash positions as of November 2, 2017, as well as (for calendar year taxpayers) December 31, 2016 and 2015. Net accounts receivable (i.e. receivables in excess of payables) are included in cash among other cash equivalents.

In GTM’s experience performing this complex calculation for multiple clients, there is no substitute for going through the full calculation, considering all tax attributes such as ODLs, OFLs, and FTC carryforwards depending on the Senate or House Bill (which does not require OFL recapture on the mandatory dividend).

E&P Study

Tax groups must have a complete and accurate understanding of their E&P position as they go through the tax reform process. This is particularly important for calculating the amount of deferred foreign earnings deemed repatriated. Even for departments who keep current E&P schedules, the testing date requirements (E&P must be determined for November 2 and December 31, 2017 in the House bill and November 9, 2017 in the Senate version) will require new calculations which do not coincide with regular reporting periods. Historical foreign tax returns may also have to be reviewed to assess FTCs which can be applied against the deemed repatriation.

Tax Planning

Following the usual recommendations to accelerate deductions and defer income to take advantage of lower rates, taxpayers may be able to use changes in accounting method to reduce E&P ahead of the first testing date and take advantage of the corporate tax rate drop. Filing the Form 3115 to be effective for the 2017 tax year may allow taxpayers to incorporate the full Section 481(a) adjustment in their determination of the testing date E&P. Transactions accounted for under the new method before November 2 (House) or November 9 (Senate) would then also affect the testing date E&P amounts.

Companies should also begin considering planning opportunities to minimize their exposure to the possible base-erosion taxes included in both House and Senate bills. For example, multinational groups should reconsider their supply chains and intragroup royalties, R&D, and management charges in anticipation of the excise tax on payments to related foreign corporations in the House bill and the minimum tax in the Senate bill. Similarly, the tax on high return CFCs in the House bill and the analogous tax on Global intangible low-tax income (GILTI) in the Senate version (along with non-recognition of gain on inbound distributions of intangible property and a preferential tax rate on foreign-derived intangible income) may warrant a reexamination of where companies hold intellectual property. The Senate bill also contains a broad anti-inversion provision which must be taken into account when considering future international M&A activities. This area is certain to be an intense focus of regulatory activity after passage of tax reform.

There is no Better Time than the Present

We hope that this post has given you a small taste of the opportunities and challenges that tax reform presents to your business. Tax reform proposals in both chambers evolve as we move towards final passage, so it’s essential to keep up with the latest changes.

GTM’s Federal, State, and International tax experts are ready to help you navigate how these impending changes will impact your organization’s tax operations specifically.

Contact Raymond Wynman to discuss your organization’s tax reform needs.

Read more about our Tax Planning and Minimization Services