Blake Lowry, Supervisor, GTM Tax Automation Services

30-Second Summary

- Tax Departments that license ONESOURCE Income Tax are preparing for the 2019 compliance season amid a significantly changed environment.

- ONESOURCE Income Tax’s International Module 2019.045 and 2019.062 updates include enhancements to GILTI workpapers and calculations, dividend depletion changes, foreign audit updates, and more.

- This article shares practical tips and advice on how to improve your 2019 compliance process and reduce preparation time.

The 2018 Tax Year brought considerable changes to international tax compliance due to the Tax Cuts and Job Act (TCJA, or “Tax Reform”). We hunkered down and managed to get through the compliance season. However, 2018 left many asking: could the same be expected for Tax Year 2019? Tax Year 2019 has presented us with several new challenges, not only with the COVID-19 pandemic, a new work environment, and the Coronavirus Aid, Relief, and Economic Security (CARES) Act, but also with additional revisions to international tax compliance.

Tax Departments that licensed ONESOURCE Income Tax’s International Module during Tax Year 2018 benefited from the software’s ability to adopt the new rules and regulations for TCJA. This adoption followed IRS regulations that brought forth calculations for Global Intangible Low-Taxed Income (GILTI), Foreign-Derived Intangible Income Deduction (FDII), Base Erosion and Anti-Abuse Tax (BEAT), a new 163(j) Limitation on Business Interest, new forms (8990, 8991, 8992, and 8993), updated forms (5471 Schedule E-I, G, I-I, J and P), and many new data entry screens.

ONESOURCE released ONESOUCE Income Tax version 2019.045 on April 24th and ONESOURCE Income Tax version 2019.062 on June 5th. These two releases for Tax Year 2019 focused on changes and updates to the International Module. Corporate taxpayers who license ONESOURCE Income Tax’s International Module should be aware of the new changes from version 2019.045 and 2019.062 within the software, and how these changes can improve the 2019 compliance process and reduce preparation time.

Here are some of the more relevant updates from 2019.045 and 2019.062 that software users should know.

2019.045 Updates|

ONESOURCE Income Tax version 2019.045 features a new look and feel, including several updated international screens. These include:

GILTI Workpaper

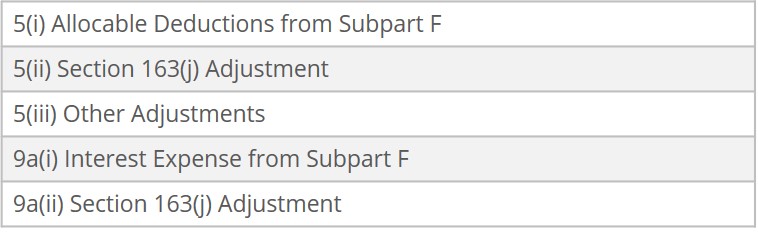

IRS form 5471 Schedule I-1 has been updated for Tax Year 2019 to include supplementary information around Interest Expense and Interest Income. The Tested Item Sourcing and Translation tab of the ONESOURCE Income Tax International GILTI workpaper has been updated for these changes. Additional data entry fields have been added:

Updated lines include:

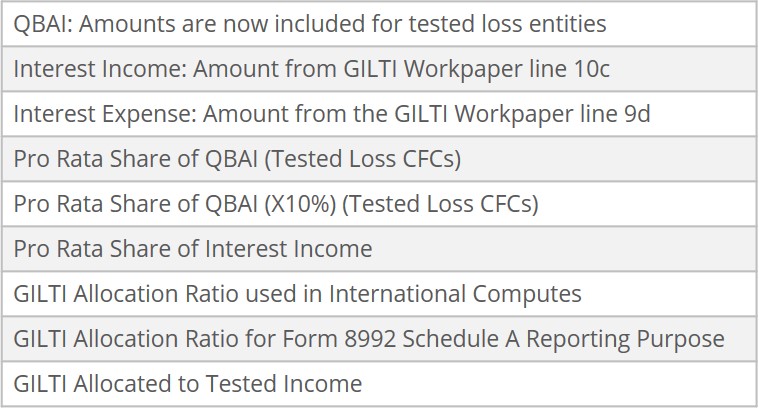

GILTI Calculations and Form 8992 Schedule A Report

IRS Form 8992 Schedule A for Tax Year 2019 has been modified to include reporting related to Interest Income and QBAI related to tested loss entities. The ONESOURCE Income Tax International Subpart F / GILTI / Form 8992 Schedule A – U.S. Shareholder CFC Detail Report provides information for entry or import into Form 8992, and now includes new columns and revisions:

Screen Redesign for Tax Year 2019 Post-86 E&P and Taxes

Post-86 E&P and Taxes Workpaper. Data entry of Post-86 Earnings & Profits and Post-86 Taxes screens have been combined into a single Post-86 E&P and Taxes Workpaper. Individual columns have been created for each PTEP category, eliminating the need for the Special PTI Categories columns used in earlier versions. The new Post-86 E&P and Taxes Workpaper contains nine sections – one for each Activity Type – that can be expanded or collapsed.

Dividend Depletion changes and the Section 959 (c)(1)(a) and 959(c)(2) reconciliation reports for Tax Year 2019 (and later)

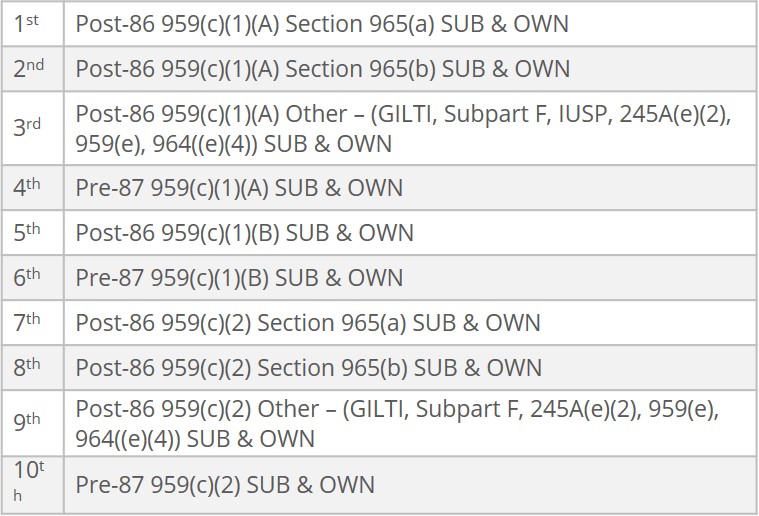

ONESOURCE updated the distribution process of previously taxed income (PTI), or previously taxed E&P (PTEP), for all tax year 2019 and later. Within the 959(c)(1)(A) and 959(c)(2) previously taxed categories, amounts are tracked and subdivided into various PTEP classifications. Distributions from PTI will continue to be processed in ascending chronological date order (first in, first out) based on the dates in the Intercompany Payments Dividends tab. When a dividend distribution is made from a tax year 2019 (or later) foreign entity binder, previously taxed E&P will be distributed as follows:

The annual layers within each group are depleted on a LIFO Basis (post-86 before pre-87) aggregating the OWN and SUB categories and prorating between them when the distribution requires less than the combined OWN + SUB amount in the layer. After, the previously taxed earnings are depleted any remaining distributions will be made from 959(c)(3) E&P in a manner consistent with prior years.

2019.062 Updates

Foreign Audit Update

The foreign audit update allows you to reroll foreign entity historical tax attributes to an existing set of binders from one year to the next year. Ending Balances of the historical tax attributes (E&P and Tax Pools and Layers, Hovering Deficits, Qualified Deficit, PTI in US$ Basis, and Subpart F Recapture) in the source binders will replace any existing information in the destination binders of the selected entities.

Automation of form 5471 Schedule J Part I for Tax Year 2019

This update includes the new PTEP categories added to the Post-86 E&P and Taxes workpaper from release 2019.045:

- 245A(e)(2)

- 959(e), 964(e)(4)

- Investment in U.S. Property (959(c)(1)(A) only)

Automation of form 5471 Schedule P Part I for Tax Year 2019

This update includes the new PTEP categories added to the Post-86 E&P and Taxes workpaper from release 2019.045:

- 245A(e)(2)

- 959(e)

- 964(e)(4)

- Investment in U.S. Property (959(c)(1)(A) only)

Automation of form 5471 Schedule P Part II for Tax Year 2019

For tax year 2019, previously taxed E&P is not only reported in functional currency (Schedule P Part I), but is also reported in U.S. Dollars on Schedule P Part II. As is the case for Schedule I and consistent with tax year 2018, ONESOURCE creates a single Schedule P that represents the consolidated group ownership. During Subpart F calculations, the U.S. Dollar basis of Previously Taxed E&P is calculated using beginning balance information from the PTI in U.S.$ Basis data entry screen and amounts calculated on the Post-86/Pre-87 PTI Exchange Gain/Loss reports. These U.S. Dollar amounts will be multiplied by the aggregate ownership of related FTC binders that are 10% or greater shareholders or those with CFC Overrides set to Treat as a U.S. Shareholder over the sum of the related and unrelated qualified FTC ownership percentage.

Automation of form 5471 Schedule I for Tax Year 2019

During Subpart F computes, current year inclusions are calculated for the U.S. Shareholders of each foreign corporation. For tax year 2019, Schedule I (Summary of Shareholder’s Income from Foreign Corporation) requires a breakdown of Subpart F Income between foreign base company and personal holding company classifications and the specific identification of dividends received by the U.S. Shareholders that are eligible for 245A treatment. The aggregate amounts for the related entities within the consolidated group are presented on the Summary Report for U.S. Shareholders. To divide total Subpart F income on the Summary Report between the various Schedule I Subpart F lines, ONESOURCE analyzes the amounts on the Section 954(b)(4) High Tax Election Report line “Net Income Not Excepted”, referring to the Subpart F Type of each source code as defined on the Source Code Definition screen.

PTI Exchange Gain/Loss Calculation/Report for Tax Years 2019 (And Later)

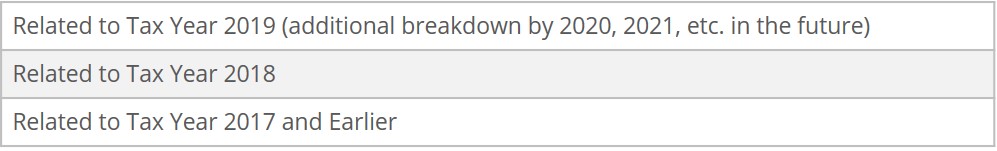

When previously taxed income (PTI) is distributed to U.S. shareholders, a gain/loss on currency fluctuation is calculated as the difference between the U.S. dollar value of the PTI on the distribution date compared to the U.S. dollar value when the income was originally recognized as a taxable inclusion. In tax years 2017 and earlier, the Separate Category checkbox in the FTC Defaults screen was used to direct the Post-86 and Pre-87 gain/loss calculations to compute using either a “by basket” or “by basket and 959(c) category” approach. While this option will continue to influence the behavior of the Pre-87 calculation, a single “by basket by 959(c) category by PTI/PTEP sub-category” method will be used for Post-86 distributions in tax year 2018 (and later) binders.

The Post-86 PTI Exchange Gain/Loss calculation and report is enabled in version 2019.062 for tax year 2019 binders. The basic mechanics of the gain/loss calculation are consistent with the prior year. Each PTEP category within Section 959(c)(1)(A), 959(c)(1)(B) and 959(c)(2) is tracked separately:

- PTI Exchange Gain/Loss is computed for each individual 959(c)/PTEP combination (other than Section 965(b))

- New PTEP categories (245A(e)(2), 959(e), 964(e)(4) and IUSP (959(c)(1)(A) only)) added in 2019.045 are included in the calculation/report

This update also incorporates PTI in U.S. Dollar Basis – that is, “pooling” for tax years 2017 and earlier earnings/Individual layer tracking for tax years 2018 and later earnings.

Separation of amounts in each section of the report

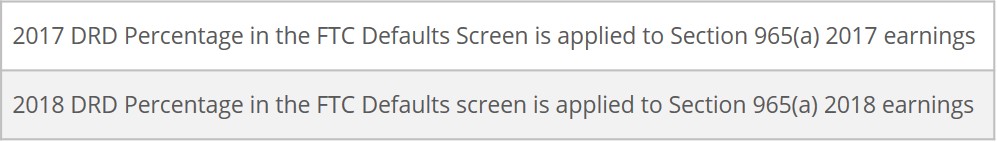

Section 965 Dividend Received Deduction (DRD)

For more information about ONESOURCE Income Tax and how to improve your compliance process, please contact me at BLowry@gtmtax.com.

About GTM’s Tax Automation Services (TAS)

GTM’s industry-leading team are experts in implementing, enhancing, and maintaining tax technology for large, multinational organizations. We take a flexible, individualized approach, working side-by-side with you to address your specific challenges and implement value-added solutions in all tax functional areas. Our tax automation services focus on Corporate Tax Software Implementation & Enhancements; Data Management & Business Intelligence; Tax Collaboration Technologies; and Process Assessment & Automation.