As COVID-19 has impacted business across the country, various government programs have been put in place to assist companies and keep people working. The Employee Retention Credit (ERC) – especially in 2021 – is one of the best programs to supplement employee wages and keep you running.

Imagine a restaurant chain that has been forced to close its dining rooms because of COVID-19 government orders. Or a movie theater chain that hasn’t been able to open in more than a year. These businesses have been faced with very difficult decisions about keeping or laying off employees due to cashflow and revenue concerns.

Now imagine being able to use an additional $33,000 per employee to supplement operations. This could be the difference between closing the shop or staying in business. The ERC could be that difference.

Needless to say, COVID-19 has negatively affected thousands of businesses across the country. The impact has been due to forced government shutdowns, lockdowns and quarantining, unemployment or reduced income, and worst of all, sick employees unable to work.

To assist companies, the government has implemented a tax saving programs to incentivize the retention of employees. Specifically, the Employee Retention Credit is focused on companies that have:

- Kept their employees as opposed to letting them go;

- Been forced to reduce or shut down operations due to government orders; and/or

- Have seen significant revenue reduction compared to 2019 (plus more options for 2021)

ERC: What’s the Benefit?

The ERC was originally introduced in the CARES Act, which was passed in mid-2020 as a refundable tax credit. At that stage, we knew companies would need help; we just didn’t know how much and for how long. The benefit was somewhat conservative, but still a good boost to qualifying companies. In the months since, the ERC has been extended and enhanced twice, most recently in early April 2021.

In short, the potential benefits of Employee Retention Credits include:

- 50% of a maximum $10K in wages (including benefits) for each eligible employee in 2020, or $5K per eligible employee for the year

- 70% of a maximum $10K in wages (including benefits) for each eligible employee per quarter of 2021, or $28K per employee for the year

The key provisions are broken out into two main categories:

- Government shutdowns – companies forced to reduce or shutdown operations due to government orders, and

- Reduced Gross Receipts – companies with significantly reduced gross receipts.

For both categories, the rules and benefits are different depending on the number of employees. When the ERC began, and what’s in force for 2020, the employee number threshold to differentiate between small and large businesses was 100. For 2021, that number was increased to 500.

Government Shutdowns

If your company was forced to shut down or reduce operations by government orders, you may be able to claim Employee Retention Credits. The key is that you kept your employees even if they worked less hours due to the forced reduction in hours. Again, this is an incentive to retain employees. If employees were laid off as a result of the shutdowns, you don’t get benefit for their severance.

For companies with 500 or fewer employees (100 for 2020), the credit amount is simple. You can use all employee wages to calculate your ERC limits. This means that if you were forced by government order to shut down or reduce operations, you can take the credit for the time period you were shut down.

For companies with more than 500 employees (100 for 2020) it’s more complicated. You can take credit for the specific employees you continued to pay fully even though their hours were reduced. Therefore, you have to calculate the hours worked compared to the non-shutdown expected hours worked. You also have to determine the scope of the shutdown and what counts and what doesn’t.

Reduced Gross Receipts

The other qualifying factor, and the one more likely to be in play is related to gross receipts. If you have significantly reduced gross receipts, quarter over quarter compared to calendar 2019, then you qualify.

The employees eligible for the credit are determined the same way as with government shutdowns – i.e., all employees for companies under threshold, affected employees for companies over threshold – but the trigger is different.

For 2020, the program started in March 2020, and was in place until the end of the year. Eligibility starts the first quarter in which your gross receipts are reduced by 50% or more compared to the same quarter in 2019 and ends when you’re back up to 80% or more of gross receipts compared to the same quarter in 2019.

For 2021 there are two phases, January to June, and July to December. In the first half of the year the reduction in gross receipts only has to be 20% or more compared to the same quarter in 2019, or for the immediate preceding quarter. This allows companies without operations throughout 2019 to claim the ERC.

For July to December, the gross receipts thresholds are the same as the beginning of the year, but one important addition was made. If you gross receipts are reduced by 90% or more compared to the same quarter in 2019, the number of employees is irrelevant. This means that large companies can benefit as well based on all employees, not just those with reduced hours.

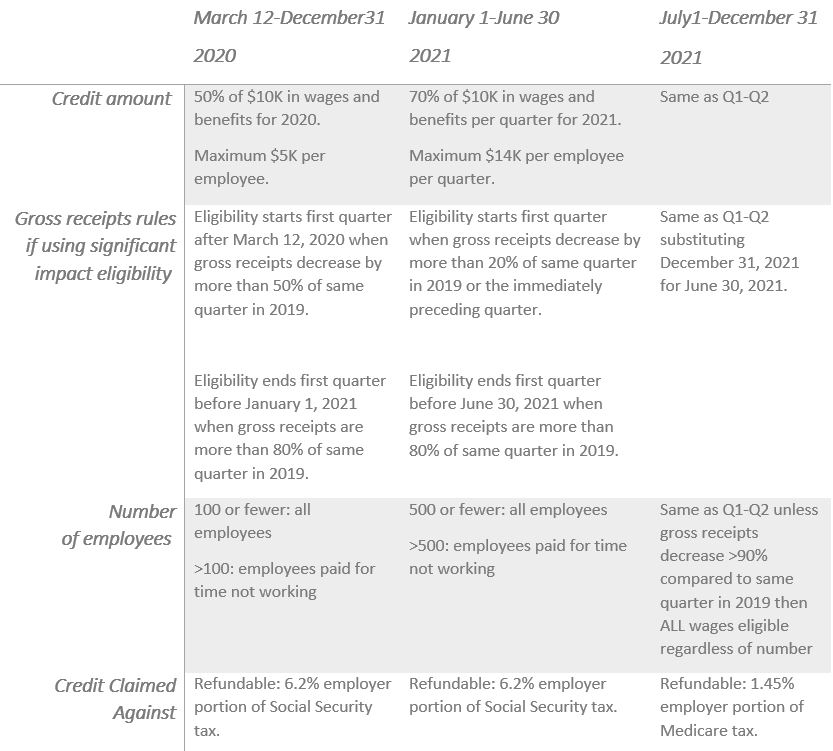

The following is a summary of credits, thresholds, and timeframes.

Keep in mind that these credits do work in conjunction with other programs and credits – e.g., R&D tax credits and the Payroll Protection Program – and rules are in place to make sure that only eligible expenses are used for each of the programs with minimal overlap.