In December 2024, the IRS and Treasury Department published Sec. 987 final regulations[1] finalizing the 2023 Sec. 987 proposed regulations.[2] Now is the time to review your existing Sec. 987 method, calculate your Sec. 987 pretransition gain/loss, and evaluate the many elections available under the final regulations.

30-Second Summary of Final Regulations:

- Clarify and expand the definition of an eligible pretransition method.

- Clarify recognition of pretransition gain or loss, provide a new small business exception from recognition of pretransition gain or loss, and provide that taxpayers that did not apply an eligible pretransition method must compute pretransition gain or loss only for taxable years beginning on or after September 7, 2006.

- Final regulations generally do not apply to a partnership, and do not apply to an eligible QBU if a partnership owns the eligible QBU’s assets and liabilities. Pending future guidance, taxpayers must apply Secs. 987 and 989(a) with respect to partnerships using a reasonable method consistent with the statute.

- Simplifications to the Current Rate Election will use elements of the earnings and capital method in lieu of preparing a tax basis balance sheet. New 2024 proposed regulations also contain a Recurring Transfer Group Election to simplify accounting for disregarded transactions.

- Changes to Loss Suspension Rule will add a de minimis exception and lookback rule.

- Simplifications to determining amounts of remittances.

The final regulations apply to tax years beginning after December 31, 2024, aligning with the applicability dates in the 2023 proposed regulations. Accelerated applicability of the final regulations continues to apply to a terminating Sec. 987 QBU if both:

- The Sec. 987 QBU terminates on or after November 9, 2023, or as a result of an entity classification election filed on or after November 9, 2023, and effective before November 9, 2023, and;

- Neither the 2024 final regulations nor the 2016 and 2019 Sec. 987 final regulations would apply to the Sec. 987 QBU when it terminates but for this accelerated applicability date.

Along with the 2024 final regulations, IRS and Treasury released new 2024 proposed regulations[3] which provide an election to simplify the computation of unrecognized Sec. 987 gain or loss on certain recurring transactions. The new 2024 proposed regulations would apply to tax years beginning after the date they are adopted as final. However, taxpayers may rely on the proposed regulations for a tax year in which the 2024 final regulations apply, provided that each member of the consolidated group and Sec. 987 electing group consistently follow the proposed regulations consistently and in their entirety. Comments are requested by March 11, 2025.

In this article, we highlight a few key clarifications and changes made by the 2024 final regulations and suggest a few action items for taxpayers. Unless otherwise noted, all references below to “Reg. §” refer to the 2024 Section 987 final regulations.

1. Eligible Pretransition Method

The final regulations clarify and expand the definition of an eligible pretransition method under Reg. §1.987-10(e)(4). The final regulations provide that a taxpayer is treated as applying an eligible pretransition method even if the taxpayer made an error in the application of its method or did not apply the method in all taxable years in which it was the owner of the Sec. 987 QBU.[4] However, taxpayers are required to compute pretransition gain or loss under Reg. §1.987-10(e)(2) as though the eligible pretransition method had been applied without error for all prior taxable years. For example, if a taxpayer made an error in applying its method for a prior year, the deemed termination amount under Reg. §1.987-10(e)(2)(i)(A) is equal to the amount of Sec. 987 gain or loss the taxpayer would have recognized on termination if it had not made the error and its Sec. 987 QBU terminated on the day before the transition date.

If a taxpayer consistently used a reasonable convention to apply Sec. 987 before the transition date, the taxpayer must use the same convention in determining pretransition gain or loss under Reg. §1.987-10(e)(2) .[5] Thus, unlike a taxpayer that made an error in applying its pretransition method, a taxpayer that used a reasonable convention would not be required to recompute pretransition gain or loss without regard to the convention. Similarly, if a taxpayer had a consistent practice under which it did not account for frequently recurring disregarded transactions in determining the amount of Sec. 987 gain or loss recognized upon a remittance, this practice is not treated as an error.[6] However, this rule does not apply unless the taxpayer reasonably accounted for the disregarded transactions in determining the amount of unrecognized Sec. 987 gain or loss with respect to the Sec. 987 QBU (for example, in the case of a taxpayer applying the 1991 proposed regulations, by adjusting the equity and basis pools to reflect the amount of each transfer).

Unchanged from the 2023 proposed regulations, if an owner applied an eligible pretransition method, any pretransition gain or loss equals the Sec. 987 gain or loss that the owner would have recognized under its existing method as if the Sec. 987 QBU terminated on the day before transition date (ignoring application of the deferral and loss suspension rules), plus the owner’s functional currency net value (“OFCNV“) adjustment.

Under the final regulations, a taxpayer which applied an earnings only method before the transition date and does not make a Current Rate Election for the taxable year beginning on the transition date does not make an OFCNV adjustment with respect to historic assets.[7]

Pretransition Gain/Loss Examples

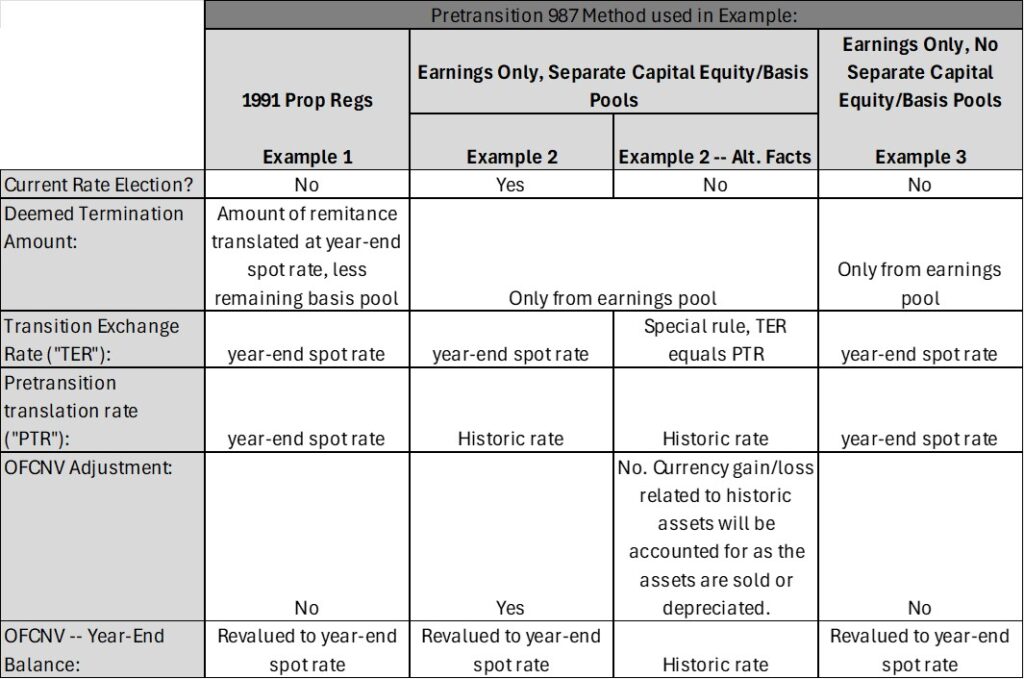

The regulations include a series of 3 examples illustrating how to determine the deemed termination amount and OFCNV adjustment under various Sec. 987 pretransition methods.[8]

Example 1 provides for using the 1991 proposed regulations but in the first year of applying the final 987 regulations, the taxpayer is not making a current rate election. Example 2 is calculating Sec. 987 gain or losses under an “earnings only” method but accessing the capital pool once the “earnings only” pool is exhausted. This example also is not making a current rate election. However, Example 2 has alternative facts where a current rate election is made. Finally, Example 3 is the more classic “earning only” method when distributions in excess of the earnings pool result in no Sec. 987 gain or losses. This Example also considers no current rate election.

For purposes of the examples:

- DC is a domestic corporation with the U.S. dollar as its functional currency and Branch is a section 987 QBU with the euro as its functional currency.

- DC has a taxable year ending December 31, and the transition date is January 1, year 4.

- DC formed Branch on November 30, year 1, with a contribution of €150.

- In year 1, Branch purchased a parcel of unimproved land for €100.

- In year 2, Branch earned €25. In year 3, Branch again earned €25.

- On June 30, year 3, Branch distributed €100 cash to DC, and DC immediately exchanged the €100 for $135.

The table below summarizes the output from these three examples:

In short, DC recognizes a deemed termination amount but no OFCNV adjustment if it applied the 1991 Sec. 987 proposed regulations as its pretransition method (Example 1). Under an earnings only pretransition method, DC would have no deemed termination amount (due to the entire earnings pool having been distributed in Year 3), but a OFCNV adjustment is required due to the Year 4 Current Rate Election which revalues the QBU’s basis in its land from the historic rate at the time of the purchase of the land in Year 1 to the year-end spot rate, increasing the OFCNV of the branch as of the last day in Year 3 (Example 2). If a Current Rate Election is not made, there is no OFCNV adjustment, but the OFCNV of the branch remains at the historical rate (Example 2, alternative facts).[9] Finally, if DC used an earnings only pretransition method under which it did not maintain equity/basis pools with respect to the branch’s capital, DC has no deemed termination amount or OFCNV adjustment, and the OFCNV of the branch on the last day in Year 3 is stepped up to the year-end spot rate (Example 3). In our experience, most taxpayers on an “earnings only” Sec. 987 pretransition method more closely resemble the purely earnings only approach of Example 3 than the hybrid approach of Example 2.

2. Recognition of Pretransition Gain or Loss

The final regulations introduce a new de minimis rule for small businesses. A qualifying taxpayer may elect to treat all QBUs that fall below the de minimis threshold as having no pretransition gain or loss. To qualify for the de minimis rule, the owner of a Sec. 987 QBU must have gross receipts that fall below the threshold for the small business exception in Sec. 163(j)(3) (i.e., gross receipts of $25 million or less, indexed to inflation and averaged over the prior three-year period). If this test is met, the de minimis rule applies to any Sec. 987 QBU with gross assets of less than $10 million, averaged over the same 3-year period and taking into account the assets of all Sec. 987 QBUs in the same country that are owned by the same owner or a member of its controlled group.[10]

When a QBU has been operating for a long period, computing annual unrecognized Sec. 987 gain or loss for all taxable years since the QBU’s inception could be burdensome. Accordingly, the final regulations provide that taxpayers that did not apply an eligible pretransition method must compute pretransition gain or loss only for taxable years beginning on or after September 7, 2006,[11] the date on which the 2006 Sec. 987 proposed regulations were issued.

In a change from the 2023 proposed regulations, pretransition loss with respect to a Sec. 987 QBU (other than a terminating QBU) where a Current Rate Election is in effect (but an Annual Recognition Election is not) is treated as net accumulated unrecognized Sec. 987 loss rather than Sec. 987 suspended loss.[12]

The final regulations clarify the application of the amortization election in the case of a terminating QBU. Under Reg. §1.987-10(e)(5)(ii)(C), any deferred Sec. 987 gain or suspended Sec. 987 loss with respect to a terminating QBU that has not been recognized before the first taxable year in which the Sec. 987 regulations are generally applicable is subject to amortization beginning in that year. However, the final regulations do not modify the treatment of Sec. 987 gain or loss that has already been recognized before the transition date; thus, such Sec. 987 gain or loss is not subject to amortization.

The final regulations also clarify that, when a terminating QBU has suspended Sec. 987 loss in a taxable year before the final regulations are generally applicable, Sec. 987 gain with respect to a taxpayer’s other Sec. 987 QBUs is assigned to a recognition grouping under the method applied by the taxpayer before the transition date. The owner recognizes suspended Sec. 987 loss with respect to a terminating QBU only to the extent of its net Sec. 987 gain in the same recognition grouping for the taxable year.[13]

3. Treatment of Partnerships

In a significant change from the 2023 proposed regulations, the final regulations generally do not apply to a partnership, and do not apply to an eligible QBU if a partnership owns the eligible QBU’s assets and liabilities.

Pending future guidance, taxpayers must apply Sections 987 and 989(a) with respect to partnerships using a reasonable method consistent with the statute. For example, if a domestic corporation owns an interest in a foreign partnership (which would use the euro as its functional currency if it is treated as a QBU under Sec. 989(a) ), and the partnership owns an eligible QBU that uses the Swiss franc as its functional currency, the domestic corporation may apply Sec. 987 to the eligible QBU under an aggregate approach. Alternatively, under an entity approach, the partnership could be treated as a Sec. 987 QBU of the domestic corporation, and the eligible QBU could be treated as a Sec. 987 QBU of the partnership. The domestic corporation could also apply a hybrid approach under the principles of the 2023 proposed regulations. However, taxpayers will not be considered to have applied a reasonable method unless they apply the same method consistently from year to year with respect to a particular partnership or eligible QBU. Members of a controlled group that are partners in the same partnership must apply the same method with respect to a particular partnership or eligible QBU, but unrelated partners are not subject to a consistency requirement.[14]

4. Simplifications to the Current Rate Election

The final regulations modify the existing framework of Reg. §1.987-4 to allow taxpayers that make a Current Rate Election to use certain elements of the earnings and capital method in lieu of preparing a tax basis balance sheet. These modifications are expected to minimize the compliance burden of transitioning from the 1991 proposed regulations to the final regulations. Under the final regulations, if a Current Rate Election is in effect, OFCNV is computed by determining the aggregate basis of the QBU’s assets, net of the QBU’s liabilities, in the functional currency of the Sec. 987 QBU (“QBU net value”) and translating the QBU net value into the owner’s functional currency at the year-end spot rate.[15] The final regulations provide that QBU net value can be computed without a tax basis balance sheet using the formula provided in Reg. §1.987-4(e)(2)(iii).

The formula provided in Reg. §1.987-4(e)(2)(iii) is modeled on the formula used to track the equity pool under the 1991 proposed regulations, with certain modifications. Under this formula, the QBU net value on the last day of the taxable year is equal to the QBU net value at the end of the preceding taxable year, adjusted by transfers of assets and liabilities between the Sec. 987 QBU and its owner and by income or loss of the Sec. 987 QBU (each determined in the Sec. 987 QBU’s functional currency). If a taxpayer determines QBU net value under Reg. §1.987-4(e)(2)(iii), the taxpayer must retain the information used to determine QBU net value for each taxable year in lieu of retaining adjusted balance sheets.[16]

Under the 2024 proposed regulations, taxpayers that have made a Current Rate Election could elect to translate a group of frequently recurring transfers between a Sec. 987 QBU and its owner using the yearly average exchange rate, rather than the spot rate on the applicable date of each transfer (the “Recurring Transfer Group Election”). A recurring transfer group of transactions means a group of frequently recurring transfers between a Sec. 987 QBU and its owner (or another eligible QBU of the owner) that are made in the ordinary course of a trade or business. These transactions would only include transfers made in connection with sales of inventory, payments for services, or rent or royalty transactions in which arm’s-length compensation has been paid. Exceptions exist for disproportionate transfers.

5. Changes to Loss Suspension Rule

The final regulations limit the scope of the loss suspension rule to cover transactions that would otherwise result in the recognition of substantial Sec. 987 losses. Under §1.987-11(c)(2), if a Current Rate Election is in effect, Sec. 987 loss is not suspended unless the amount of Sec. 987 loss subject to suspension in the taxable year exceeds the lesser of $3 million or two percent of the controlled group’s gross income. This threshold is applied collectively to the Sec. 987 loss of the owner and all members of the owner’s controlled group.

The final regulations also provide a lookback rule under which a suspended Sec. 987 loss is recognized to the extent of net Sec. 987 gain recognized in the current year and the three preceding taxable years.[17] Taxable years beginning before the transition date are not included in the lookback period.

6. Simplifications to Determining Amounts of Remittances

The final regulations provide two modifications that are intended to reduce the burden of tracking disregarded transfers for purposes of Reg. §1.987-5 while preserving consistency with the text and purpose of Sec. 987. First, the final regulations provide an alternative formula for computing the annual remittance that does not require tracking of individual transfers but contains an adjustment to account for remittances out of current-year income. Under this formula, the remittance amount is equal to the negative change in net value of the Sec. 987 QBU (determined in the QBU’s functional currency), adjusted for income and loss of the Sec. 987 QBU.[18] Mathematically, this formula will produce an amount that is equal to the aggregate net transfer from the Sec. 987 QBU to its owner for the taxable year.

Second, Reg. §1.987-5(b) and (c) provide that the numerator and denominator of the remittance proportion (that is, the amount of the remittance and the Sec. 987 QBU’s gross assets) are determined in the Sec. 987 QBU’s functional currency, rather than the owner’s functional currency. As a result, it is not necessary to separately translate each transfer for purposes of determining the annual remittance.

7. Action Items

With the 987 final regulations now in effect for tax years beginning in 2025, taxpayers should complete the following analyses:

- Assess whether historical Sec. 987 method is an eligible pretransition method within the new clarified and expanded definition of the final regulations.

- Assess whether historical approach to partnerships under Sec. 987 is a reasonable method consistent with the statute.

- Compute pretransition gain or loss:

- Calculate unrecognized Sec. 987 as if the QBU terminates on 12/31/2024 (the deemed termination amount).

- Taxpayers on an eligible pretransition method should assess whether there were any errors in the application of the pretransition method which must be corrected in calculation of the deemed termination amount.

- Taxpayers not on an eligible pretransition method must use the simplified FEEP method in the final regulations.

- Calculate OFCNV adjustment if required, depending on taxpayer’s pretransition method and whether a Current Rate Election will be made for 2025.

- Consider the impact of any QBUs which terminated on or after November 9, 2023, and are subject to early adoption of the Sec. 987 final regulations.

- Calculate unrecognized Sec. 987 as if the QBU terminates on 12/31/2024 (the deemed termination amount).

- Consider whether the various elections under the Sec. 987 final regulations should be made (e.g., ten-year amortization of pretransition gain/loss, Current Rate Election, Annual Recognition Election, Recurring Transfer Group Election).

- Evaluate ASC 740 impacts related to both historical Sec 987 deferred tax positions as well as 2025 effective tax rate implications for recognized gain/loss amounts under the various post transition elections.

Contact GTM’s International Tax Team

GTM’s International Tax Services team can assist you with all aspects of Sec.987. If you want to learn more about the final 987 regulations or discuss how these changes might impact your business, contact us below.

[3] REG-117213-24 (Dec. 11, 2024).

[4] Reg. §1.987-10(e)(4)(iv).

[5] Reg. §1.987-10(e)(4)(v)(B)( 1 ).

[6] Reg. §1.987-10(e)(4)(v)(B)( 2 ).

[7] Reg. §1.987-10(d)(3)(ii).

[8] Reg. §1.987-10(l), Ex. 1–3.

[9] Reg. §1.987-10(l)(2)(iii).

[10] Reg. §1.987-10(e)(7).

[11] Reg. § 1.987-10(e)(3)(ii)(A).

[12] Reg. §1.987-10(e)(5)(i)(B)(2).

[13] Reg. §1.987-11(f).

[14] Reg. §1.987-7(b).

[15] Reg. §1.987-4(e)(2)(i) and (ii).

[16] Reg. §1.987-9(b)(2).

[17] Reg. §1.987-11(e)(3).

[18] Reg. §1.987-5(c)(2).