Under current tax law, taxpayers have a one-time opportunity under Section 864(f) to elect to use worldwide interest expense apportionment on their 2021 tax returns. The 864(f) election may be beneficial for taxpayers who are subject to residual U.S. tax on GILTI due to apportionment of interest expense to the GILTI basket. However, Congress is considering repeal of Section 864(f) as part of the latest CARES Act relief package. Taxpayers should move quickly to model to understand the potential benefit of a Section 864(f) election in their fact pattern, and assess the impact (if any,) on their Q1 2021 tax provision. Now is also the time for taxpayers to evaluate whether they should contact their trade organization or Congressional representative about the implications of repealing this provision.

Background: What Is Tax Code Section 864(f)

For purposes of the foreign tax credit limitation under Section 904, the allocation and apportionment of interest expense is generally based on the principle that money is fungible, and therefore attributable to all of a company’s business activities and assets.[1] Section 864(e) requires interest be allocated to each member of an affiliated group as if all members of the group were a single corporation. This “lookthrough” treatment does not apply to foreign subsidiaries, so that the stock of foreign subsidiaries is treated as an asset in the hands of the U.S. affiliated group which draws interest expense apportionment (generally to foreign-source income). The result of this water’s-edge rule is potentially an over-allocation of interest expense to foreign income and a reduction in the Section 904 FTC limitation.

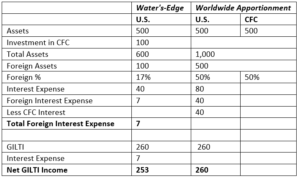

To illustrate, assume a simple example with one domestic corporation and one CFC. Each has assets with adjusted basis of 500 and 40 of interest expense each (80 in total). The U.S. also has 260 of GILTI income. The domestic corporation’s basis in its CFC stock is 100:

To correct this problem, the American Jobs Creation Act of 2004 added Section 864(f) to the code, allowing taxpayers to elect to allocate and apportion interest expense on a worldwide basis for taxable years beginning after December 31, 2008. Congress has since delayed the election’s availability three times, apparently due to the provision being scored as a significant cost to revenue, but Section 864(f) has finally become effective for taxable years beginning after December 31, 2020 (i.e., 2021 for calendar-year taxpayers).

Over-allocation of expenses to foreign income is particularly problematic for taxpayers in an excess credit position in the GILTI FTC basket. For many taxpayers subject to tax rates on foreign income above 13.125%, expense allocation to GILTI results in residual U.S. taxation (after FTCs), and no carryforward of excess GILTI FTCs is permitted. Although regulatory changes have somewhat reduced this problem (e.g., the treatment of CFC stock as partially exempt assets[1] and the GILTI high-tax exception election[2]), worldwide interest expense apportionment under Section 864(f) may still be beneficial in many fact patterns.

However, the Coronavirus relief package currently being assembled by House Democrats[3] would repeal Section 864(f) as one offset to keep the total cost of the package below the $1.89 trillion limit of the fiscal 2021 budget resolution. Revoking the election would raise $22.33 billion over 10 years, according to an estimate by the Joint Committee on Taxation.

Worldwide Interest Expense Apportionment Details

Although the provision was enacted more than fifteen years ago, Treasury has never issued regulations under Section 864(f), presumably due to the multiple delays in effective date. Treasury is currently in the preliminary stages of writing guidance under Section 864(f) and is seeking taxpayer comments on areas to be addressed. Until guidance is issued, taxpayers face uncertainty in attempting to model the consequences of Section 864(f) for tax planning and provision purposes, especially where 864(f) interacts with changes made to U.S. international taxation under the 2017 Tax Cuts and Jobs Act (“TCJA”) and subsequent regulations.

If a Section 864(f) election is in effect, the taxable income of each domestic corporation that is a member of a worldwide affiliated group is determined by allocating and apportioning the interest expense of each member as if all members of such group were a single corporation.[4] The statute attempts to do this by:

- Determining the amount of interest allocable to foreign assets by taking the total interest expense of the worldwide affiliated group multiplied by the ratio of foreign assets to total assets of the worldwide affiliated group;

- Reducing by the interest expense of the foreign corporations in the worldwide affiliated group to the extent such interest is allocable to foreign source income; and

- Defining the excess as the interest expense of domestic members allocable to foreign source income.[5]

For purposes of the calculation, a worldwide affiliated group includes:

- Includible members of an affiliated group as defined in section 1504(a), determined without regard to the exception for insurance companies subject to taxation under Section 801; and

- All controlled foreign corporations in which such members in the aggregate meet the 80% vote and value Test of section 1504(a)(2) either directly or indirectly through applying the indirect ownership rules of Section 958(a)(2) or through applying similar rules to stock owned directly or indirectly by domestic partnerships, trusts, or estates.[6]

Presumably, rules to further define a worldwide affiliated group may be required, similar to the rules defining CFC group in the GILTI high-tax exception and Section 163(j) CFC group election contexts.

How Changes to TCJA Impacts International Corporate Tax

Guidance from Treasury will be needed to coordinate the statutory scheme with the TCJA’s changes to U.S. international taxation. For example, the statutory formula does not take into account the addition of foreign branch and GILTI FTC baskets or exempt Section 245A income, which did not exist prior to the TCJA. The approach to characterizing CFC stock under current Reg. §1.861-13 will also need to be revised, including the treatment of CFC stock as partially exempt and consequent adjustment under Section 904(b)(4). Section 864(f) states that expenses other than interest which are not directly allocable or apportioned to any specific income producing activity are allocated and apportioned as if all members of the affiliated group were a single corporation.[7] This could require, for example, that recently issued regulations on apportionment of stewardship expenses under the asset method[8] be revisited. These open areas will need to be addressed in forthcoming regulations, assuming Section 864(f) is granted a reprieve. Since Section 861 tends to follow the same overarching mechanical constructs throughout (e.g., pro rata allocations based on gross income or assets), taxpayers can make educated assumptions about how to further divide any foreign source interest between baskets or how to treat certain assets as exempt.

The election to adopt the worldwide interest expense apportionment methodology must be made by the common parent of the affiliated group on the 2021 tax return. If the eligible taxpayer does not make the election for 2021, the election is forgone and cannot be made for a later taxable year. The election is binding “for such taxable year and all subsequent years unless revoked with the consent of the Secretary.”[9]

Significant Opportunities for Taxpayers

Taxpayers have been waiting for Section 864(f) to finally become effective, only to now be faced with the prospects of having it repealed before even implementing it. With this possibility looming, taxpayers should model the benefit of making the election and evaluate options to communicate the importance of this provision to Congress.

Section 864(f), if retained in the Code, could be a significant opportunity for taxpayers to lessen their foreign source interest expense apportionment.

[1] Reg. §1.861-8(d)(2)(ii)(C)(2)(ii).

[2] Reg. §1.951A-2(c)(7).

[3] H. R. 133

[4] Section 864(f)(1)(A).

[5] Section 864(f)(1)(B).

[6] Section 864(f)(2).

[7] Section 864(f)(2).

[8] Reg. §1.861-8(e)(4)(ii)(C).

[9] Section 864(f)(6).