The federal research and development (“R&D”) tax credit offers companies of all sizes an opportunity to recoup certain eligible costs. These recouped costs, in the form of a dollar-for-dollar credit, offsets their annual tax bill. While the required federal form that is filed with a company’s tax return, Form 6765 which has had proposed changes in 2024, may seem straightforward, many companies overlook opportunity and risk areas that may increase their overall benefit and mitigate exam exposure. In many cases, the reason is as simple as utilization. Companies with net operating losses (“NOLs”) cannot use the credit, so they choose to file an estimate, claim the “low-hanging fruit”, or not claim at all with the intention to do a thorough calculation in the future when they can use the credits.

Identifying, computing, and documenting Qualified Research Expenses (“QREs”) can be a nuanced exercise. As business activities, finance, and accounting processes change, companies may have to change how they identify and document QREs to manage audit risk. Despite a lack of formal documentation requirements for the U.S. R&D credit, we strongly advise having an effective methodology for computing QREs, calculating credits, and retaining contemporaneous documents as evidence of the QREs claimed to limit exam exposure. It will also save time and money in the long run.

The R&D credit can have significant impacts on reducing effective tax rates, increasing earnings per share, and determining ASC 740-10 implications for uncertain tax positions. Therefore, a thorough review should be a standard part of a company’s annual tax planning process. That said, are there any specific situations that should trigger a comprehensive review for all open tax years?

Who Should Revisit R&D Claims?

You should revisit your R&D claims if your company:

- Prepares claims internally

- Has used the same service provider for many years with little change in credit or fees

- Is coming out of NOLs and expecting to use R&D credits in the near future

- Is preparing for any M&A activities, or has recently acquired or divested businesses

- Has expanded into new states, sells state credits, or plans to transfer credits

- Expects a large increase in your R&D credit, has made significant investments in R&D efforts, or hired technical personnel

- Uses similar, if not the same qualified activity allocations for individuals every year

While this is not a complete list of situations that should draw attention to a R&D tax credit review, many of the above fact patterns can have considerable impacts to benefits and risks.

Let’s take a look at an example and identify some considerations that could have an impact on a company’s R&D credit claim.

Case Study Example

Life Sciences, Inc. (“company”) is a pharmaceutical company that is developing a new drug to treat a rare form of blindness. The company has typically operated with losses year over year and prepares the federal R&D tax credit study internally as part of its annual tax review process.

The company claims the follow Qualified Research Expenses (QREs):

- Wages for qualified services from its R&D department

- Contract Research Expenses from a trial balance account “R&D-Contract Research Organization”

- Supplies from a trial balance account “R&D-Lab Supplies”

The company recently received FDA approval for one of its pipeline drugs and expects to have significant revenue and a large tax bill that will offset most of the carryforward NOLs this year. Since the company’s R&D tax credit carryforwards will start to become realized as they anticipate offsetting remaining income taxes, the company should review its R&D studies. This review should include all open years, to ensure that it is taking advantage of every opportunity to maximize its benefit while minimizing risk at the same time.

What Aspects of R&D Tax Credit Studies Should be Reviewed?

Wages for Qualified Services

-

- Are there additional personnel outside of the core R&D function that have been left out of prior studies? Eligibility for the R&D credit is based on the activities personnel are performing, as opposed to a specific department or job title that is associated with those individuals. In many cases personnel in non-core R&D departments perform qualified activities, including Information Technology, Quality Assurance, Sales, Marketing, and the C-Suite. Individuals who are (a) directly involved with, (b) directly supervising, or (c) directly supporting qualified research activities (“QRAs”) are all eligible and can likely add a significant amount of additional QRE to the study.

-

- The company should ensure that it is applying a QRA percentage allocation against each employee’s W-2 Box 1 (taxable) wage. Completing this analysis at the employee level computes a more precise wage QRE amount and is often something that taxing authorities will expect to see upon review of a R&D calculation.

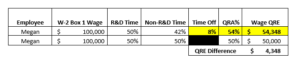

- Did the company appropriately compute everyone’s qualified research activity allocation percentage appropriately? Employees who contribute 80% or more of their time to QRAs can be included in the calculation as 100% of their total W-2 Box 1 wage amount for that year. “Time Off” or time when no activities were performed at the company (e.g., vacation, holiday, sick time, jury duty) at an individual level should be removed from the equation in computing everyone’s QRA allocation percentage. For example, if an employee makes $100,000 and spends 50% of her time on QRAs and the remaining time on non-R&D activities and four weeks of Time Off (roughly 8% of her total time) there is a considerable difference in what should be computed as her portion of wage QRE by making the adjustment to Time Off as opposed to simply applying 50% to her wage amount.

This difference, compounded by every employee who is included as part of the claim, can have a material impact on the overall amount of a company’s R&D credit.

Contract Research Expenses

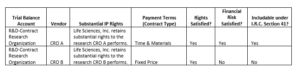

- Did the company perform contract review to establish that they have substantial rights and are at financial risk for the activities that the contractor has performed for them? Analysis should be performed at the vendor level to determine which activities and related costs appropriately satisfy the requirements under I.R.C. Section 41. To do this, after determining that the contractor is performing activities that meet the QRA qualifications, reviewing and documenting both the intellectual property rights and payment terms for each contract provides the necessary support needed to include these costs:

Doing this analysis and preparing the necessarily documentation – or, at the very least, identifying and retaining the contracts that support the contract research expense QRE – will save time and effort in the event of an exam and give you confidence in the amounts that are being included in the R&D credit computation. Simply taking a total amount from a trial balance account, even if booked strictly as R&D-related costs, is not sufficient. A more detailed level of review is required.

- The company should ensure that it is generally computing contract research expenses at 65% of its total or gross amounts.

- Did the company only include US-based contractors? If a contract covers work performed by both US-based and Non-US contractor resources, has an appropriate allocation been made to carve out the non-US based work? Like what is includable for wage QRE, the test relies on where the work was physically performed as opposed to where the vendor is located.

Supplies

- Do all supply QREs meet the following eligibility requirements

- Tangible property other than land or improvements to land, and property of a character subject to the allowance for depreciation; and

- Used in the conduct of qualified research if they are used in the performance of qualified services

-

Did the company ensure that no capital equipment was included?

-

Can the company tie the consumable supplies directly to a specific business component where those supplies were used or consumed during the process of experimentation?

Nexus & Documentation

When it comes to maximizing QRE and ensuring that the quantitative aspects of the claim are being identified and captured correctly, a company should also be keeping in mind that QREs must be associated with business components (e.g., product, process, or software). This allocation ties QREs to what was being developed or improved in some way and may then be supported with examples of contemporaneous documents that were created during the normal course of the QRAs.

Companies like Life Sciences, Inc. may have a captured QREs appropriately, but quantitative documentation without demonstrating nexus and having qualitative support will often be inadequate by itself on exam. The results of not analyzing what level of supporting detail has been retained can prove to be costly on exam and may be especially difficult to collect in the future.

Why Not Wait Until We Use the Credits?

The examples above highlight some of the more nuanced aspects of evaluating costs and including them as QREs. Applying I.R.C. Section 41 rules appropriately and determining the validity of the QREs claimed can ultimately impact a company’s overall tax position.

Taking a more proactive, annual review approach can prove to be a worthwhile investment of your time to ensure that the costs are valid, and that substantiation exists. Often, having to go back to prior years to shore up these studies are costly and imperfect solutions – why?

· Employee turnover can impact access to key information and context to what was being claimed in the past. Knowledge and history leave with the employee – including your credit support.

· With time, people’s memories of what development efforts entailed and who was involved may not provide a complete picture of things leading to missed opportunities. Many people can’t remember what they had for lunch last week, let alone what they worked on five years ago.

· Documentation retention policies may impact how much substantiation is available to support prior year QREs.

· Implementing new technologies, processes, and capabilities often creates opportunity areas to increase R&D claims but can also change where supporting data exists or how accessible it may be.

In the past, we have referenced how to improve the R&D tax credit process with the 3 Ts. Taking a more proactive approach ensures that you may rely on the credits that end up on your return. Leveraging Technology, Training and Tracking may help drive a repeatable, technology-driven process that focuses on maximizing credits and reducing risk.

Although the specific examples discussed above serve as good triggers for when a fresh look into a research credit study is beneficial, perhaps the more important message is that as your business changes and evolves so does your R&D credit. Given its significant value, it is worth the time and effort to take the steps necessary to prepare a claim that maximizes your investment in development efforts while managing audit risk.

Global Tax Management (GTM) can help you determine your R&D tax credit opportunities, and help you navigate other tax challenges in the ever-changing and complex landscape we live in today. Learn about our R&D Tax Credits Services here. For more information, please contact me at jforman@gtmtax.com.