The federal research and development (“R&D”) tax credit is a valuable benefit that companies across most industries take advantage of. The credit has been around for about 40 years, and is promoted well by service providers and industry associations across the country. In fact, each year more than $12B in credits are claimed federally. Not surprisingly, companies tend to focus on the federal credit.

In addition to the federal credit, more than 30 states offer similar incentives. In fact, some are more generous than the federal program. Most – though not all – state programs follow the guidelines of the federal credit when it comes to qualified research activities (“QRAs”) and qualified research expenses (“QREs”). They also, like federal rules, require activities to be performed in their jurisdiction to qualify. Many companies, however, are unaware of, ignore, or treat state R&D incentives as an afterthought. If proactively considered, state R&D credit planning can be both lucrative and strategic.

R&D Tax Credit Considerations

Does the state offer R&D tax credits?

Although most states offer R&D credits, not all do. In addition, not all state credits are created equal, and although most follow the federal guidelines, some do not. As an example, Connecticut QRE eligibility is based on I.R.C. §174 as opposed to §41 resulting in a larger pool of QREs.

Many companies operate in multiple jurisdictions or in metropolitan regions between states. Examples include:

a. New York City

b. Philadelphia

c. Washington D.C.

d. Chicago/Milwaukee

e. St. Louis

f. Kansas City

g. Cincinnati

When planning to locate R&D resources, the location can make a difference between getting a credit of 30% or more to 0%. With $1M of qualified spending, that’s $300K that can be spent on additional staff and resources.

Here is a quick example from the northeast.

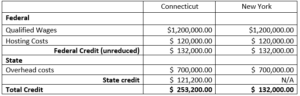

Michelle starts a software company and is looking for an office location. She plans to hire 10 software developers at an average wage (plus bonus) of $120K each. In addition, she will spend $120K on web hosting for her development team and $700K on overhead expenses for R&D. She is considering a location in Greenwich, CT, and one in Port Chester NY. The potential sites are less than 10 minutes apart and along the same public transportation route.

Comparing the two sites, we can look at the potential savings from R&D incentives:

In this example, by simply choosing a location less than 10 minutes further up the road, Michelle can save $121K – enough to hire another developer. In future years, the difference will be even more significant as Connecticut offers a second R&D credit for incremental spending increase.

This example used Connecticut, which offers up to a 6% non-incremental credit. Other states offer much higher credit rates, like Louisiana for example at as much as 30%.

Can I use the R&D tax credits?

What good is a tax credit if you are not paying tax? State credits in several states allow taxpayers to use state credits even if the company has net operating losses (“NOLs”). There are a few methods that states employ to make the credits useful currently. Some are refundable, some are transferable, and some are even sellable.

Examples of states offering benefit when credits cannot offset tax include[1]:

a. Arizona

b. Connecticut

c. Delaware

d. Hawaii

e. Iowa

f. Maryland

g. Nebraska

h. New Jersey

i. North Dakota

j. Pennsylvania

k. Virginia

In the above example, although possible, it is unlikely that Michelle’s company will be profitable in year one. That will not stop her from getting value for her Connecticut credits, though, as she can transfer them back to the state for 65% of their value.

Another example of the more attractive aspects of these special programs is the potential to sell credits. New Jersey is a good example of a state that has a program that allows companies to sell their credits or NOLs to companies that can use them for a minimum of 80% of their value. The program has a lifetime limit of $15M, but that $15M in cash is, in many cases, a lot better than $15M being carried forward to a future time of uncertain use. Do not hesitate to contact us to learn more about how the transfer program works.

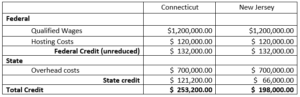

So, looking at Michelle’s company again, she realizes that New York does not make a lot of sense, but is New Jersey potentially better than Connecticut? Let us compare.

In the first year, New Jersey’s credit is still about $55K less that than Connecticut, but if she plans to cash out the credits, she will be able to get about $79K in Connecticut, and at least $53K – though closer to $60K on the open market – in New Jersey. If Michelle sells her NOLs for the year as well, New Jersey may offer an overall larger incentive than Connecticut.

Now the decision should rest on where she can get the best resources coupled with the entire state tax picture. In either case, though, New York should be out – and this is grudgingly coming from a New York resident!

Our New Normal in 2021

The world changed dramatically in 2020. Although we are going to return to “normal” in some ways, we are not in others. We have learned a lot, we have adapted, we have also improved. One area that is not likely to go back to how it was, is location-based work. Remote work is here to stay. The extent of it will vary, but it is not going away. There are state R&D tax credit implications to this.

As noted above, eligibility for state credits is dependent on the work being done in the state. Physically being done in the state. If your posterior is planted in a given state (or your feet at a standing desk) and you are performing a QRA, you qualify for a credit in that state. If, however, you are physically in a different state, you do not.

What this means is that companies must carefully analyze where their employees are physically working. For example, a company that has always taken an Ohio credit because their employees come to the office in Cincinnati, may now not be eligible because the same workers now working from home are in Kentucky. Similarly, a Philadelphia company may no longer have a Pennsylvania credit, because their workers are in New Jersey. The flip side of the second example is that they may now have a New Jersey credit.

In any event, companies must evaluate their state credit opportunities based on where employees are located, and track location like they may not have in the past.

State R&D credits are a lucrative opportunity that taxpayers should not ignore. Quite often they represent greater value to taxpayers than federal R&D credits. Generally speaking, they have been an add-on to the federal program and not given the attention they deserve. State credits can drive location decisions, and they can provide cashflow. Whether it is transferring credits for cash, or selling credits, they can provide immediate value even for start-ups and companies with NOLs.

One thing we have learned in the past year is that location is not as important as we once thought, and the bottom line is that hiring people in high-credit states is more viable than ever.

Oh, and of course we wish Michelle the best of luck kicking off her software business!

[1] States vary in eligibility and refund/transfer/sell amounts.E.g., some states only offer these benefits to eligible small businesses, others have a revenue cap on eligibility, or a maximum lifetime participation cap, etc.

Contact Jonathan directly with any questions, and to learn more about GTM’s R&D Tax Credit Services.