Webinar: Property Taxes – Navigating Uncertainty in Post Pandemic World

In this live, one-hour webinar, Robert Butterbaugh will lead attendees through the process of navigating some of the most immediate issues and challenges that influence…

Growing multinational companies juggle many tax responsibilities. Here are some tips for keeping all the balls in the air.

Internal resources may not be enough to cover all your tax needs. GTM’s co-sourcing solution is the strategic and cost-effective alternative for your tax department.

Looking to make a difference and grow professionally? GTM is 100% employee owned and actively looking for tax talent at all levels to grow with us. Interested?

Property tax is a controllable cost that impacts the bottom line through substantial cash savings. If not addressed properly, companies lose these savings opportunities by missing out on allowable deductions and exemptions. GTM’s corporate property tax advisory and outsourcing services leverage the strength of industry expertise and best practices to ensure that companies are filing correctly and taking advantage of allowable savings opportunities. Our property tax advisory services include corporate property tax compliance, valuation review and appeals, audit support, and fixed asset and reclassification reviews.

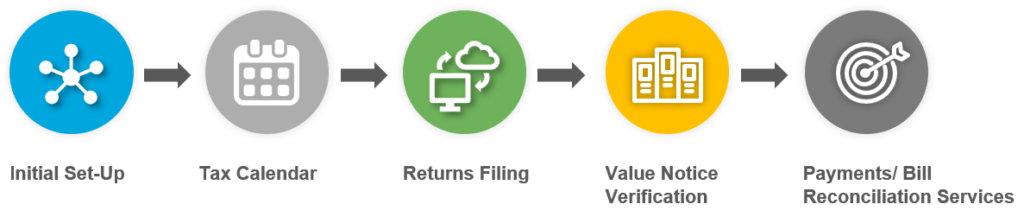

GTM’s team of property tax consultants lighten the compliance burden by streamlining and automating the processes through our proprietary process and controls. We perform the initial set-up of files, prepare a tax calendar, conduct data analysis, prepare and file renditions, review and verify value notices, reconcile tax liabilities as reflected on valuation notices and subsequent bills, and process tax bills for payment as authorized.

GTM’s property tax consultants collect data and perform analysis to tie out personal and real property tax value notices to rendered or expected values. We also evaluate the impact of internal and external events that may impact the values of the taxable assets subject to property tax and pursue those opportunities for an appeal decision. As authorized, valuation review and appeals services may include assessment appeals, discussions, negotiations, informal or formal appeal hearings, or other meetings with taxing jurisdictions or their authorized representatives. GTM uses a proactive approach to meet informally with taxing jurisdictions to negotiate equitable assessments early in the assessment process. This often avoids the need for formal, and more costly, tax appeals.

GTM represents clients during formal or desk audits that may be conducted by taxing jurisdictions or third-party auditors. With your authorization, GTM coordinates the exchange of information with the auditor and performs associated services including challenging audit assessments as appropriate.

GTM performs fixed asset reviews to identify and quantify ghost assets, exempt assets, mis-classified assets (real or personal), assets that have shorter useful lives, non-value added assets, capitalized repairs, or other non-taxable assets for its clients. These studies document the basis for pursuing adjustments for our clients and have often yielded significant savings.

There may be specific property tax triggering events that impact values of taxable assets for particular industries and company-specific properties. These include mergers, acquisitions and dispositions, asset impairments, regulatory developments, competitive marketplace developments, tax legislation and other external factors in play. GTM has experience and proprietary ideas of how to address these impacts from a property tax standpoint. In these situations, GTM provides guidance around best practices, acquisitions, pre-rendition data analysis, and other issues that require a depth of property tax technical knowledge.

In this live, one-hour webinar, Robert Butterbaugh will lead attendees through the process of navigating some of the most immediate issues and challenges that influence…

In his latest article for GTM Tax Insights, Robert Butterbaugh shares ways to efficiently and effectively optimize the property tax function through outsourcing, technology integration,…

As companies from a variety of industry sectors begin to reopen and evaluate the short- and long-term economic impact of COVID-19 on their respective businesses,…

The Dark Store Theory is putting Big Box retailers back in the spotlight for challenging the values of real estate for property tax purposes as…