This post is the first of two companion blogs following our published article in the March 5 edition of Tax Notes, “GILTI, FDII, and BEAT: Thinking Ahead to First-Quarter Provision.”[1] In Part 1 of this 2 part blog series, we present a detailed calculation of the GILTI tax, illustrating the impact of performing the calculation on a consolidated vs. entity-by-entity basis. We will then refine a point we made in the Tax Notes article on apportioning expenses to GILTI, indicating that the effects of apportioning expenses depend on the foreign tax rate and the foreign tax credit (FTC) position of the U.S. shareholder.GILTI Detailed Calculation

Please note that some of the GILTI calculation examples provided in this blog are fact specific. It is important to review the set of facts and circumstances on a case-by-case basis as the tax consequences for GILTI may vary. For the background on GILTI and the other international provisions, please consult the Tax Notes article.

Consolidated vs. Entity-by-Entity Treatment

Beginning in 2018, I.R.C. Section (§) 951A requires that a U.S. shareholder of a Controlled Foreign Corporation (CFC) include the shareholder’s Global Intangible Low-Taxed Income (GILTI) in gross income for the current taxable year. As applied to corporate shareholders, the language and legislative history of § 951A are unclear on whether the calculation is to be performed at the level of the U.S. shareholder or at the level of the consolidated group within the meaning of § 1504. Public comments by multiple IRS officials suggest that the service is leaning towards consolidated treatment, but the IRS has not officially issued any guidance on this point.

This question of entity-by-entity vs. consolidated treatment also has arisen with the § 965 toll tax and the new interest limitation under § 163(j). As applied to § 965, the IRS indicated in Notice 2018-07 that the calculation is to be performed at the consolidated group level. While the IRS has not yet issued guidance on 163(j), the Conference Report to the Tax Cuts and Jobs Act indicates that Congress also intended the provision to apply at the consolidated group level. Until Treasury or the IRS provide regulations or further guidance on § 951A, we believe the statutory language suggest the GILTI inclusion is determined at the U.S. shareholder level.

GILTI Calculation Example Facts:

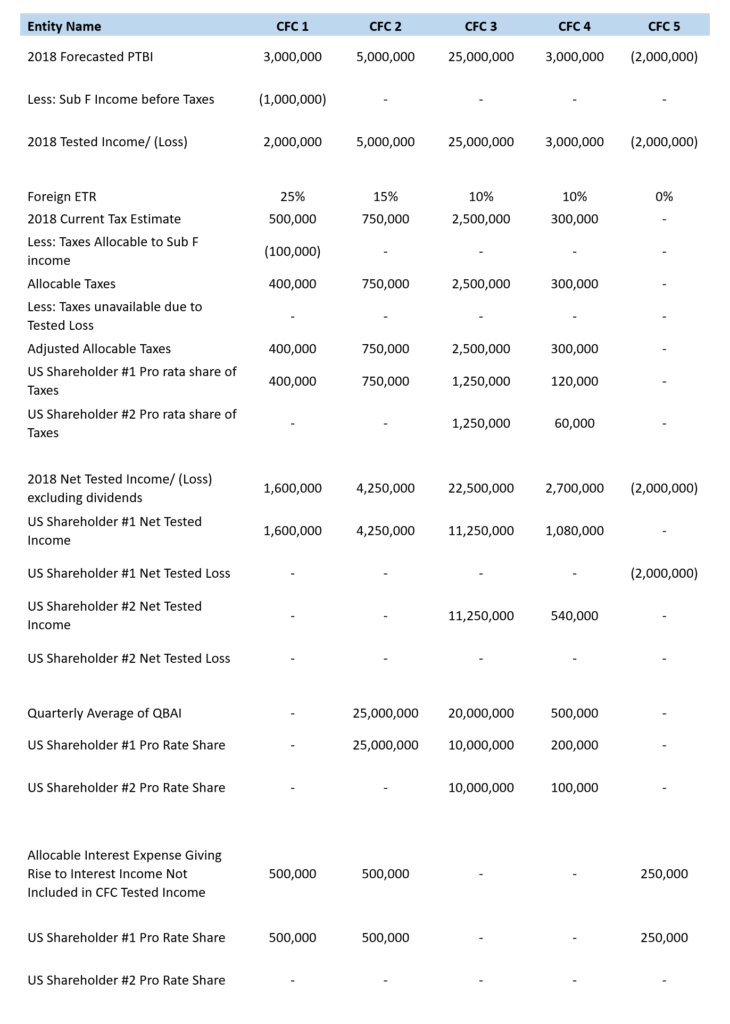

ABC Company has four U.S. corporations (US 1–4) which own five CFCs (CFC 1–5) in the following proportions:

ABC Company files a consolidated return in the U.S. The CFC data used in the determination of GILTI is as follows (Assume no intercompany dividends or high-taxed Subpart F income. Amounts are in USD.):

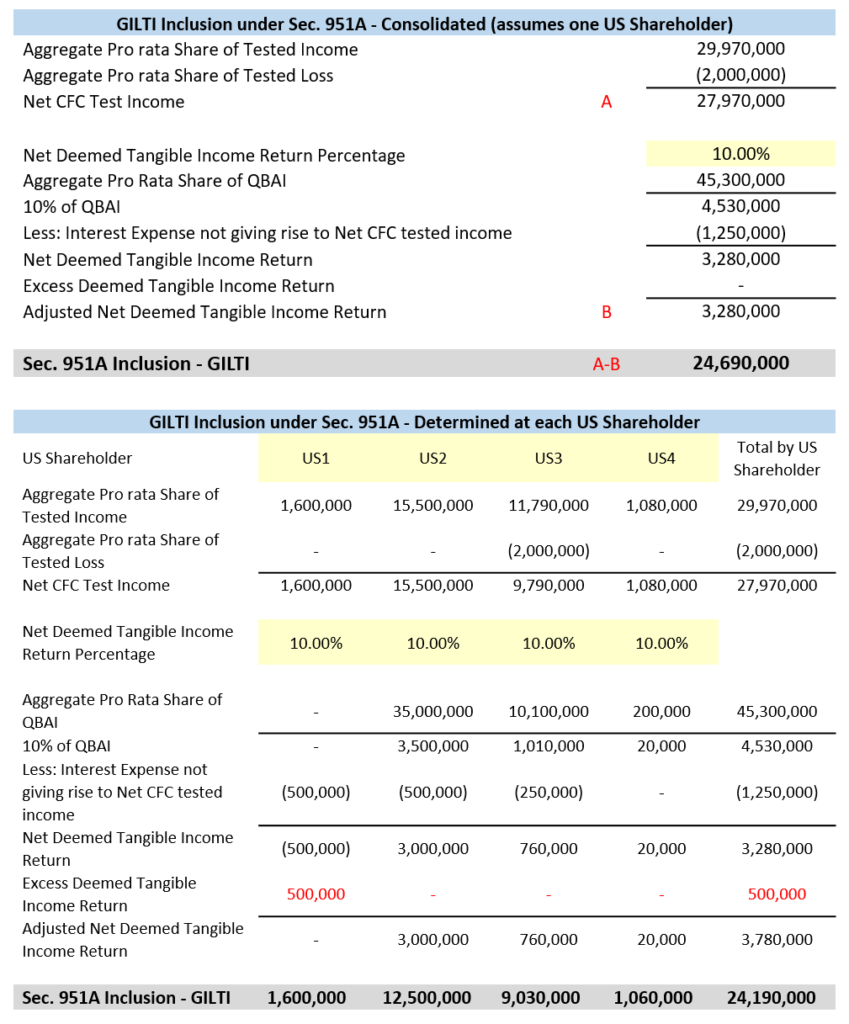

Comparison of GILTI Calculation on Consolidated Basis vs. U.S. Shareholder Value

The first difference between the consolidated and the entity-by-entity calculation of GILTI is due to the treatment of interest paid from a CFC where the interest income is not included in net CFC tested income (i.e. paid to unrelated party or up to U.S. parent). In this GILTI calculation example, the net deemed tangible income return at US1 cannot be negative. In effect, the $500,000 of interest expense at CFC 1 is disregarded which causes an increase of $500,000 in the net deemed tangible income return which reduces the net CFC tested income to be included in the US shareholders gross income under § 951A.

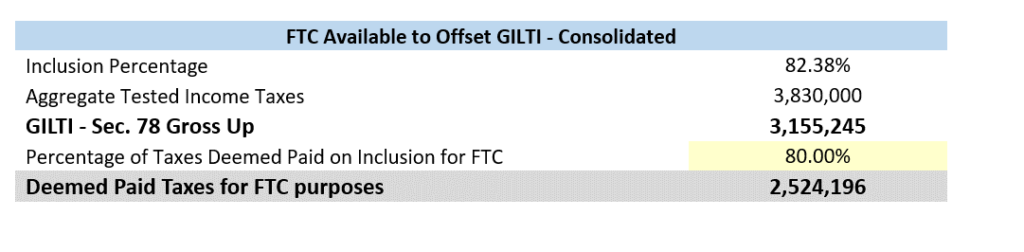

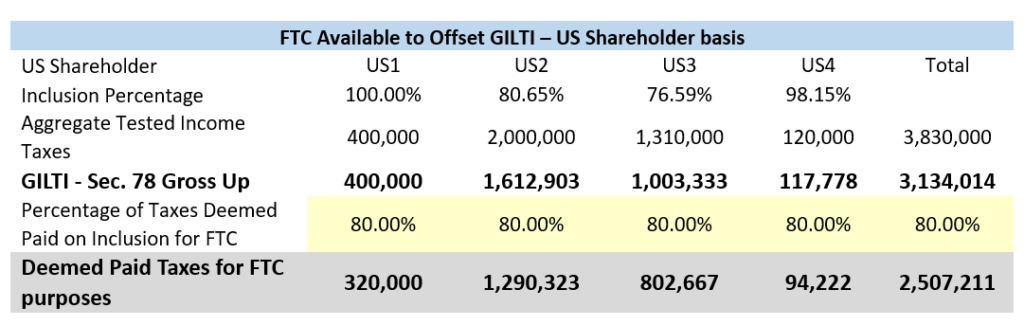

The next difference between the consolidated and entity-by-entity calculation of GILTI is on the calculation of the inclusion percentage. The inclusion percentage is determined by taking the § 951A inclusion over tested income to determine the FTCs deemed paid on GILTI.

The calculation of inclusion percentage on an entity-by-entity basis in this example results in a small reduction of FTCs deemed paid on GILTI.

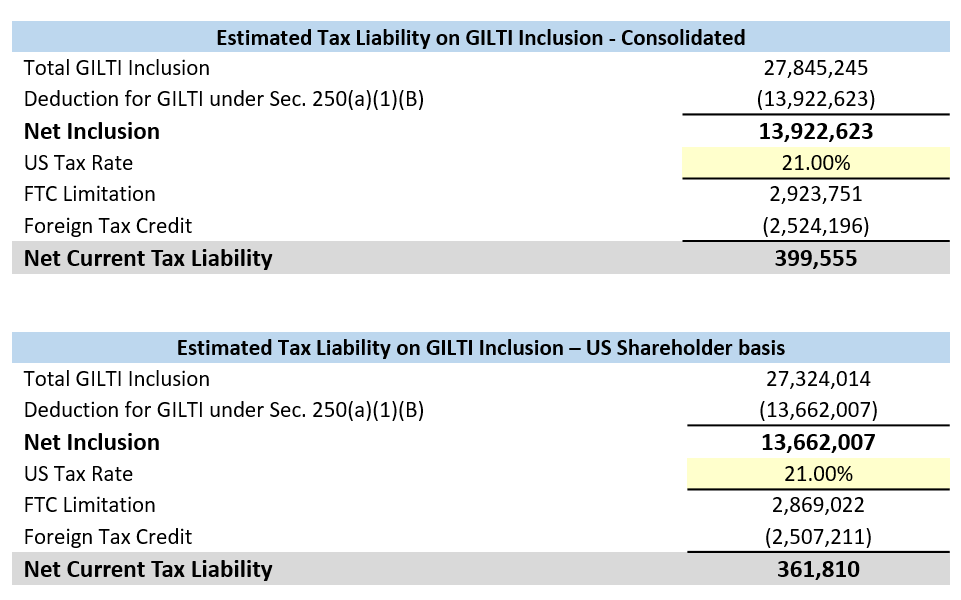

Below is an illustration of the net tax liability determined on a consolidated basis vs. U.S. shareholder basis. This assumes that the 50% deduction under § 250 is not limited by taxable income. In this GILTI calculation example, the difference in net current GILTI tax liability calculated under the two methods is approximately 10%.

Apportioning Expenses to GILTI

As discussed in the Tax Notes article, Congress’s intent that GILTI not apply above a minimum foreign tax rate of 13.125%[2] does not take into account the interaction of § 951A with existing parts of the code, particularly the expense allocation rules of Treas. Reg. 1.861-8. The article presented a basic example where the U.S. shareholder of a CFC subject to a 15% foreign tax rate on GILTI, nevertheless, had additional U.S. tax liability due to GILTI after apportioning interest expense to the GILTI basket.

A very important note: this article assumes that the § 78 gross-up on GILTI is entirely allocated to the GILTI basket. One possible interpretation of the code, as amended by the TCJA, is that the § 78 gross-up on GILTI is sourced to general limitation income and not GILTI for purposes of § 904. We believe that Treas. Reg. § 1.904-6(b)(3) (“taxes that were allocated to income in a separate category shall be treated as income in that same separate category”) as well as the legislative history of the TCJA point towards § 78 on GILTI being included in the GILTI basket. This view agrees with comments made by Marjorie Rollinson, IRS associate chief counsel (international), at a March 22 event at the International Tax Institute in New York. Stay tuned for our Part 2 of this blog series on GILTI, where we will delve deeper into this issue.

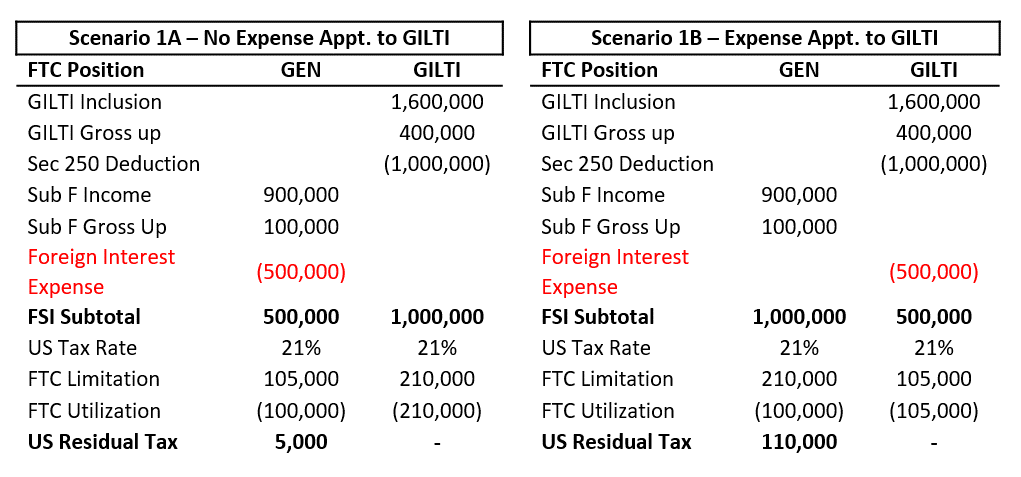

Depending on a company’s specific facts, expense apportionment does not always produce an additional U.S. tax liability and may even be helpful under specific circumstances. To illustrate, consider CFC 1 and US1 from the above example. At a foreign ETR on GILTI of 20% ($400,000 foreign tax allocated to GILTI / $2,000,000 CFC tested income), the apportionment of foreign interest expense to the GILTI basket results in $105,000 additional tax on GILTI due to the § 904 limitation. The $105,000 of additional tax represents the GILTI FTCs that are not utilized and have no future benefit.

Note: This example assumes a low effective tax rate associated with the Subpart F inclusion included in the general basket.

Apportioning expense to the GILTI bucket increases the residual tax on GILTI if we assume that US1 does not have excess FTC carryforwards in the general basket. If there is a FTC carryforward, the excess limitation created by apportioning expense out of the general basket will allow these FTC carryforwards to be utilized (remember that excess GILTI credits cannot be carried forward). This is potentially an important consideration given the limited ways of generating foreign-source income after tax reform.

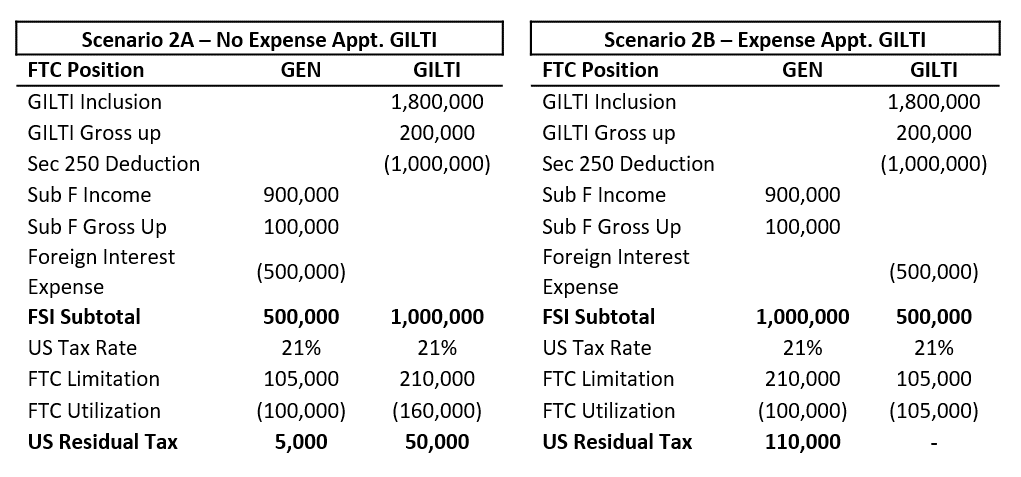

If we assume the same facts in the example above, but CFC 1 now has a 10% foreign ETR on (low-taxed) GILTI, apportioning interest to GILTI increases the total residual U.S. tax by $55,000.

Again, if US1 does have general basket FTC carryforwards, apportioning the expense to GILTI is potentially favorable to the taxpayer.

In Part 2 of this 2 part GILTI blog series, we tie together our discussion of GILTI with a review of issues created by the ambiguous drafting of § 951A, including the basketing of the § 78 gross-up on GILTI hinted at above. We also cover consideration of tax planning opportunities around GILTI.

We hope this post was helpful as you assess the impact of tax reform on your business. GTM will be publishing regular posts highlighting key features and developments of tax reform. Visit our tax reform page for the latest U. S. tax reform updates.

[1] Jim Swanick, Andrew Wai, and Raymond Wynman. “GILTI, FDII, and BEAT: Thinking Ahead to First-Quarter Provision.” Tax Notes Tax Practice, vol. 158, #10. March 5, 2018. Pp. 1367–73.

[2] Joint Explanatory Statement of the Committee of Conference, H.R. Rep. No. 115-466 (Dec. 15, 2017), at n.1526.