It has now been five years since the passage of the Tax Cuts and Jobs Act remade the U.S. international tax landscape. With taxpayers beginning to revisit their international tax calculations for year-end, we are putting together a series of short blog posts highlighting a few commonly overlooked technical issues.

In this post, we discuss the consistency rule in the allocation and apportionment of deductions to the residual grouping in applying the GILTI high-tax exception (“GILTI HTE”). This rule is particularly relevant where a holding company CFC with large amounts of interest expense holds interests in lower-tier tested units (other CFCs or foreign branches) which qualify for the GILTI HTE. If the taxpayer elects the GILTI HTE, the rule causes some interest expense of the upper-tier CFC to be apportioned to the residual income group, increasing the upper-tier CFC’s tested income, and reducing its effective foreign tax rate (“ETR”).

The Consistency Rule

For a refresher on the GILTI HTE rules, see this post.

In the GILTI HTE calculation, each tentative gross tested income item is treated as assigned to a separate tested income group, and all other income is treated as assigned to a residual income group. For purposes of applying Reg. §§1.861-9 and 1.861-9T under the principles of Reg. §1.960-1(d)(3), the amount of interest deductions that are allocated and apportioned to the assets (or gross income, in the case of a taxpayer that has elected the modified gross income method) of a lower-tier corporation, such as a corporation the stock of which is owned by the CFC indirectly through the tested unit, are allocated and apportioned to the residual income category and not to any tentative gross tested income item of the CFC.[1]

In the case of a taxpayer that has made a GILTI HTE election, in allocating and apportioning deductions to gross tested income, the taxpayer must apply the rules of Sec. 861 through 865 and 904(d) (taking into account the rules of Sec. 954(b)(5) and Reg. §1.954-1(c)) in a manner that achieves results consistent with the calculation of tested income items for GILTI HTE purposes.[2] Deductions that are allocated and apportioned to the residual income group for purposes of applying the GILTI HTE to a CFC’s gross tested income items are allocated and apportioned for purposes of determining the CFC’s net income in each relevant statutory grouping using a method that provides for a consistent allocation and apportionment of deductions to gross income in the relevant groupings. Therefore, for example, interest expense that is apportioned under the modified gross income method to a tentative gross tested income item of a lower-tier corporation may be allocated and apportioned to the tested income of the upper-tier corporation or to the residual grouping, depending on whether the lower-tier corporation’s tentative gross tested income item is an item of gross tested income or is excluded from gross tested income under the GILTI HTE.[3]

Example: The Consistency Rule

The GILTI regulations illustrate the application of this consistency rule with the following example:[4]

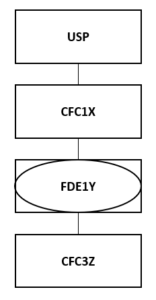

- USP owns all of the stock of CFC1X. CFC1X directly owns all the interests of FDE1Y. FDE1Y owns all of the stock of CFC3Z.

- CFC1X uses the modified gross income method to allocate and apportion its interest expense.

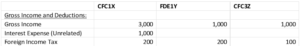

- The items of gross income and deductions of CFC1X, FDE1Y, and CFC3Z are as follows:

- The GILTI HTE calculation is as follows:

- Under the modified gross income method, CFC1X must allocate and apportion its interest expense between the CFC1X income group and the FDE1Y income group based on a combined gross income amount that includes both the gross income of CFC1X (including the gross income of both the CFC1X and FDE1Y tested units) and the gross income of CFC3Z.

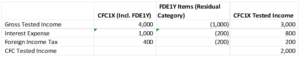

- Under Reg. §1.951A-2(c)(7)(iii), interest expense of CFC1X that is allocated and apportioned to the gross income of CFC3Z is not allocated and apportioned to either the CFC1X income group or the FDE1Y income group. Therefore, 600 of interest expense (60% of the 1,000 of interest expense) is allocated and apportioned to the CFC1X income group, and 200 of interest expense (20% of the 1,000 of interest expense) is allocated and apportioned to the FDE1Y income group. The 200 of interest expense that is allocated and apportioned to the 1,000 of gross tentative tested income of CFC3Z is allocated and apportioned to the residual income group for purposes of the GILTI HTE calculation, but can still be allocated and apportioned to a statutory grouping of tested income of CFC1X for purposes of determining CFC1X’s tested income, as shown below.

- FDE1Y is subject to a ETR above 18.9% and qualifies for the GILTI HTE.

- CFC1X’s tested income is determined as follows:

- The 1,000 of FDE1Y tentative gross tested income excluded from tested income under the GILTI HTE, as well as the 200 of interest expense and 200 of foreign tax expense allocable to that gross income, are allocated and apportioned to the residual category for purposes of determining CFC1X’s tested income.

- Because CFC3Z’s tentative gross tested income is not excluded from gross tested income under the GILTI HTE, the 200 of CFC1X’s interest expense that was apportioned to tentative gross tested income of CFC3Z under the modified gross income method is allocated and apportioned to gross tested income of CFC1X and therefore reduces CFC1X’s tested income.

- In contrast, if the CFC3Z tentative gross tested item had been excluded under the GILTI HTE, then the 200 of CFC1X’s interest expense that was allocated and apportioned to that income would be assigned to the residual category.

Conclusion

Taxpayers should keep in mind the application of the consistency rule in performing their GILTI HTE and tested income calculations. In situations where an upper-tier CFC with large amounts of interest expense owns lower-tier entities which qualify for GILTI HTE, the consistency rule can cause the upper-tier CFC itself to fail to qualify for GILTI HTE if it is close to the 18.9% ETR threshold.

To learn more about GTM’s International Tax Services or to speak with someone who can guide you through the process, contact us.