30-Second Summary

- As corporations race to ensure the safety of their workforces and comply with state mandates ahead of return-to-work, they’re purchasing personal protection equipment (PPE) in record numbers, from non-traditional vendors across the globe

- These purchases are often multi-million dollar transactions, and many are being made for the first time for multi-state locations by companies that have no prior experience with PPE taxability

- This article shares access to The COVID-19 Tax Decision Matrix, which has been developed by tax research firm TTR

Companies are preparing for return-to-work as we continue to battle the COVID-19 pandemic. As they race to ensure the safety of their workforces and comply with state mandates, they’re purchasing personal protection equipment (PPE) in record numbers – and at record prices, according to a report by The Society for Healthcare Organization Procurement Professionals (SHOPP).

Sales and Use Tax Implications of COVID-19 and PPE Purchases

The challenges posed by COVID-19 and the accelerated purchase of PPE create several big-picture issues for companies from a tax, trade, and valuation standpoint. Of immediate concern, however, is the fact that the purchase of these items are often multi-million dollar transactions per company and are sourced from non-traditional vendors on a worldwide basis. Several types of PPE are being purchased for the first time for multi-state locations by companies that have no prior experience with PPE taxability. In today’s automated procurement environment, most companies are unable to pre-select taxability of PPE based on past purchase and supplier history.

Determining PPE Taxability by State

Determining the taxability of these items is an extra burden for tax departments that are already navigating the Coronavirus Aid, Relief, and Economic Security (CARES) Act; regulatory updates; tax technology changes; and seasonal provision and compliance deadlines. However, it is crucial to understand the tax implications of PPE purchases thoroughly to protect your corporation fiscally during the return-to-work process.

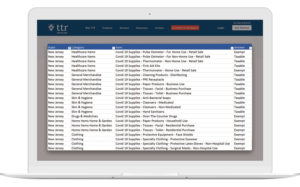

GTM is closely monitoring the sales and use tax implications of COVID-19 and PPE purchases, and has been asked to assist several companies as they navigate the taxability of PPE transactions. Research of this nature is time consuming and is quickly out of date. Through our relationship with tax research firm TTR, we are now able to provide sales and use tax answers for COVID-19 related purchases across all 50 states. The COVID-19 tax decision matrix is available from TTR as an Excel file which can be downloaded at no cost, including detailed categories and item descriptions by State along with taxability answers and citations to validate each position/decision.

At present, few states have granted special exemptions for PPE or other supplies related to COVID-19. GTM is closely monitoring the sales and use tax implications of COVID-19 and will continue to update you on any significant changes as they occur.