Sec. 965 Final Regulations: Finally, a Little Flexibility Sec. 965 Final Regulations Flexibility

By Raymond Wynman, and Andrew Wai

On January 15, 2019, the IRS released final regulations on the Sec. 965 toll tax (T.D. 9846). In this post, we highlight changes to the 965(b) basis-shifting election and the specified payment rule which add a welcome degree of flexibility to the 965 calculation. If taxpayers wish to take advantage of the revised basis-shifting election, they must act by May 6, 2019. Calendar-year taxpayers who have already filed their 2017 returns should consider whether filing an amended return reflecting the modified specified payment rule or any of the other changes in the final regulations may be beneficial.

Sec. 965(b) Basis-Shifting Election

We refer you to our prior post on the 965 proposed regulations for background on the Treas. Reg. §1.965-2(f)(2) basis-shifting election. As a quick recap, a U.S. shareholder’s income inclusion from a deferred foreign income corporation (“DFIC”) is reduced by its allocable portion of E&P deficits from its E&P deficit corporations, creating so-called 965(b) PTI at DFICs. Because U.S. shareholders do not receive basis in 965(b) PTI, distributions out of 965(b) PTI may result in capital gain under Sec. 961(b)(1). The proposed regulations offered a solution in the form of a basis-shifting election which would shift a U.S. shareholder’s basis in its deficit corporations to its DFICs in the amount of the deficits allocated under Sec. 965(b). Under the proposed regulations, the amount of basis shifted was all-or-nothing, with the unfortunate result that making the election could immediately produce capital gain if the amount of basis to be shifted exceeded the U.S. shareholder’s actual basis in deficit corporation stock.

In January 2019, the IRS issued final §965 regulations which, as an alternative to the all-or-nothing approach of the proposed regulations, added the ability for U.S. shareholders to designate the amount of basis to be shifted from each deficit corporation to each DFIC. If this selective basis-shifting election is made, the rules (1) limit the increase in stock basis of each DFIC to the DFIC’s amount of 965(b) E&P, (2) limit the total basis increases at DFICs to the total basis reductions at deficit corporations, and (3) prevent reductions in deficit corporation basis below zero (“to-the-extent rule”).1

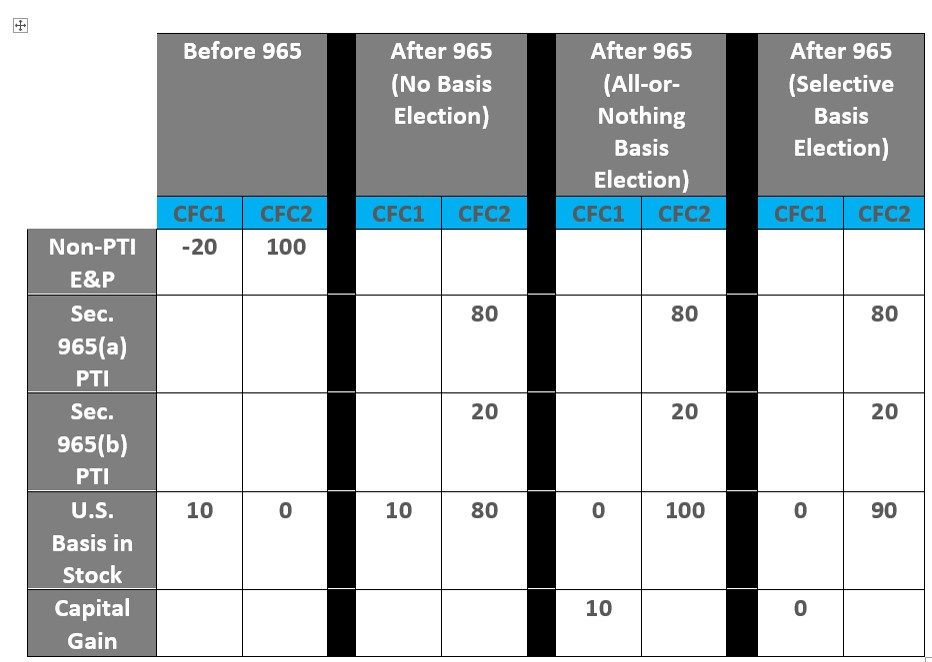

Consider the following simple example:

- US, a domestic corporation, owns 100% of foreign corporations CFC1 and CFC2 (i.e. CFCs are brother-sister).

- US, CFC1, and CFC2 are calendar-year taxpayers.

- On all measurement dates, CFC2 has accumulated post-1986 deferred foreign income of 100, and CFC1 has an E&P deficit of 20.

- US has basis of 0 in its CFC2 stock and 10 in its CFC1 stock.

Table 1: Example of Sec. 965(b) Basis-Shifting Election

The selective basis adjustment allows for an additional $10 to be repatriated from CFC2 without immediately triggering $10 of capital gain at CFC1.

The final regulations continue to impose the consistency requirements from the proposed regulations so that the basis-shifting election must be made by the U.S. shareholder and all related persons (within the meaning of Sec. 267(b) or 707(b)).2 The final regulations also clarify that the U.S. shareholder makes the basis adjustment on a share-by-share basis.3

The proposed regulations originally required that the basis-shifting election, along with all other 965-related elections, be made on a timely-filed 2017 return. The IRS relented on this deadline in Notice 2018-78 issued in September 2018 and confirmed in the final regulations. For tax returns due (with extensions) before May 6, 2019,4 the final regulations provide that the election must be made by that date. No further relief under Treas. Reg. §301.9100-2 or 301.9100-3 is available past this extended deadline. Elections made prior to February 4, 2019 may be revoked by filing an amended return and are irrevocable thereafter. The election statement simply provides the U.S. shareholder’s name and taxpayer identification number, states that the U.S. shareholder and all related persons make the election, and indicates (if applicable) that the alternative, to-the-extent basis election rules are being utilized.5

Subject to additional guidance in publications, forms, instructions, or other guidance from the IRS, the final regulations do not require any additional information to be furnished on the election statement. We believe that, since the original basis-shifting election statement was required to be attached to a timely-filed 2017 return, making the election under the transitional rules should require filing an amended 2017 return before May 6, 2019. Taxpayers will also indicate on Form 965, filed with the 2018 return, that they have made the basis-shifting election.

At a high level, companies should take the following into account as they consider whether the basis-shifting election is appropriate for their circumstances:

- Whether sufficient stock basis (from pre-2017 activity, Sec. 965(a) inclusions, or post-2017 GILTI and/or subpart F income) exists to support planned distributions

- Strategic planning around divestitures of foreign operations or post-TCJA restructuring (e.g. sale of CFC stock to third-party acquirer, conversion of CFCs into branches via check-the-box elections)

- Possible utilization of tax attributes, such as capital loss carryover/carryback

Note that, for purposes of characterizing CFC stock under Reg. §1.861-12(c)(2), the proposed foreign tax credit regulations require a taxpayer to determine its basis in SFC as if the basis-shifting election had been made, even if the taxpayer did not actually make the election. The basis increase to DFIC stock under Reg. §1.965-2(f)(2)(ii)(A) is treated as an increase due to Sec. 961 and therefore excluded from the tax book value of the DFIC stock.6

Alternative Specified Payment Rule

Under the proposed regulations, the specified payment rule (i.e., disregard rule or E&P double-counting rule) required that deductible payments made between 10%-owned specified foreign corporations (“SFCs”) which occurred between the 965 measurement dates (November 2 and December 31, 2017) be disregarded in determining E&P at December 31, 2017 if the payor and payee SFCs had different tentative 965 measurement dates before application of the specified payment rule. Many taxpayers discovered that applying this rule actually increased their overall 965 inclusions.

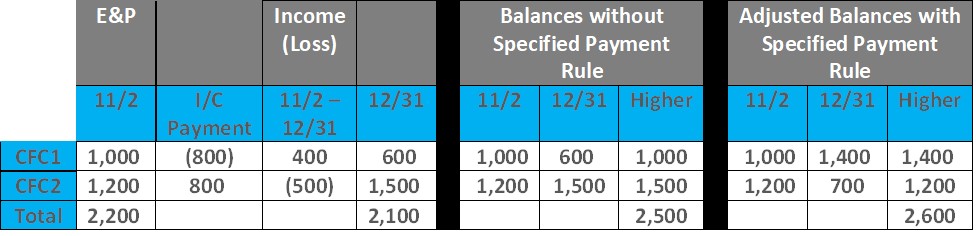

Consider again a simple example with two wholly-owned, calendar-year CFCs. CFC1 made a $800 deductible royalty payment to CFC2 on December 1, 2017:

Table 2: Example of Alternative Specified Payment Rule

CFC1 and CFC2 have different tentative measurement dates (November 2 and December 31, respectively). The specified payment rule applies and disregards the intercompany royalty payment, increasing the total Sec. 965(a) inclusion by $100.

The final regulations made two changes from the proposed regulations:

- Eliminate the requirement that SFCs have different tentative measurement dates for the specified payment rule to apply.

- Allow taxpayers to disregard the specified payment rule entirely.7

Like the basis-shifting election, the choice to disregard the specified payment rule must be applied consistently across SFCs and be made by the U.S. shareholder and all persons related within the meaning of Sec. 267(b) or 707(b).

Note that, if a taxpayer chooses not to apply the specified payment rule, a payment which may have been disregarded under the specified payment rule may then fall under one of the anti-avoidance rules in Reg. §1.965-4(b), particularly the disregard of E&P reduction transactions.8

An amended 2017 return likely needs to be filed if a taxpayer wishes to recalculate its Sec. 965 without the specified payment rule. Subject to future IRS guidance, the choice not to apply the specified payment rule itself does not require filing a separate election statement or other indication on the Sec. 965 transition tax statement.

As we rapidly approach the deadline for the basis-shifting election to be made, please do not hesitate to reach out to us if you have any questions or concerns on your Sec. 965 toll tax calculation or filing obligations. We emphasize once again that the various Sec. 965 statements and elections described here and in our previous post on Sec. 965 reporting cannot be filed late, so make sure that you understand all of the implications of the Sec. 965 final regulations for your company.

[1] Reg. §1.965-2(f)(2)(ii).

[2] Reg. § 1.965-2(f)(2)(iii)(A).

[3] Reg. §1.965-2(h)(4).

[4] Ninety days after publication of the 965 final regulations in the federal register. Due to the government shutdown, publication was delayed until February 4, 2019.

[5] Reg. § 1.965-2(f)(2)(iii)(B)

[6] Prop. Reg. §1.861-12(c)(2)(i)(B)(1)(ii).

[7] Reg. §1.965-4(f)(3).

[8] See 965 Final Regulations, Summary of Comments and Explanation of Revisions at V.B.4.

We hope this post was helpful as you assess the impact of tax reform on your business. GTM publishes regular posts highlighting key features and developments of tax reform. Visit our tax reform page for the latest U. S. tax reform updates.