Sec. 965 Proposed Regulations Highlight Surprise Issues with Basis

By Raymond Wynman, and Andrew Wai Calculating & Reporting: Sec. 965 Toll Tax Liability

On August 1, the IRS released the first batch of proposed regulations (regs) on the Sec. 965 toll tax (REG-104226-18). For the most part, the regs are in line with existing guidance published earlier this year in IRS Notices 2018-07, 2018-13, and 2018-26. However, we wanted to draw attention to an issue highlighted by the proposed regs which may result in a U.S. shareholder recognizing capital gains on receipt of distributions from its CFC out of “trapped” Sec. 965 previously taxed income (PTI) if the shareholder has insufficient basis in the CFC stock. Understanding this issue is extremely important as many companies have already planned for significant cash repatriation in 2018 based on the assumption that such distributions would be tax-free to the extent of Sec. 965 PTI.

An election, discussed below, is available to make adjustments in basis to follow the allocated 965(b) PTI with the possible downside of immediately triggering capital gain. We have developed a tool to assist our clients as they determine whether making the election fits with their specific facts. As the election must be made on a timely filed return (with extension), please contact us as soon as possible if you have any questions on 965.

As a follow-up to our previous post on 965 filings, we also mention a few of the elections and statements mentioned in the proposed regs. Taxpayers who have already filed their 2017 returns should consider whether filing an amended return is required to reflect the new guidance.

Sec. 965(b) Adjustments to basis

Under Sec. 965(b), a U.S. shareholder’s income inclusion from a deferred foreign income corporation is reduced by its allocatable portion of E&P deficits from its E&P deficit corporations. Sec. 965(b)(4) treats this deficit allocated by Sec. 965(b) deficit as previously taxed income (PTI, Sec. 959). Sec. 965(o)(1) grants the Secretary authority to prescribe regulations to provide for appropriate basis adjustments resulting from Sec. 965.

Consider the following example: US, a domestic corporation, owns 100% of foreign corporations CFC1 and CFC2 (i.e. CFCs are brother-sister). US, CFC1, and CFC2 are calendar-year taxpayers.

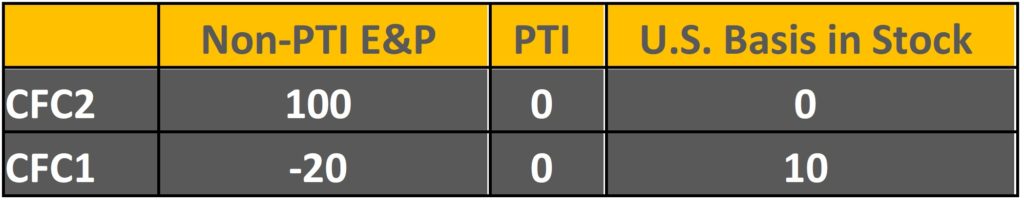

On all measurement dates, CFC2 has accumulated post-1986 deferred foreign income of 100, and CFC1 has an E&P deficit of 20. US has basis of 0 in its CFC2 stock and 10 in its CFC1 stock.

Before Sec. 965:

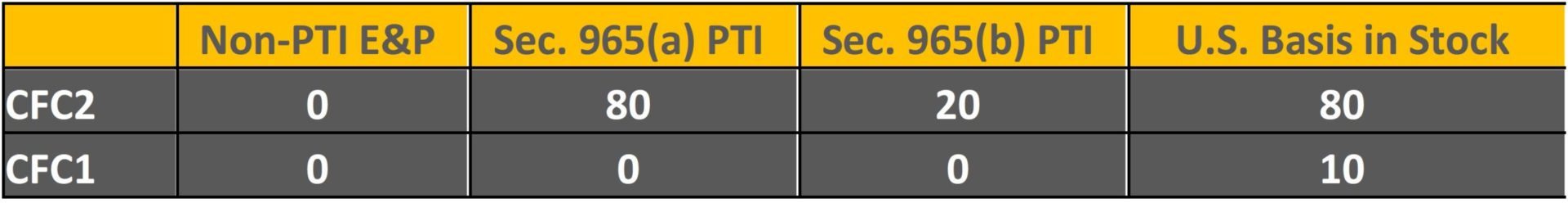

Sec. 965(a) results in a net inclusion from CFC2 of 80, and the E&P of CFC1 is increased by the 20 of deficit taken into account under Sec. 965(b)(4).[1] In general, no adjustment to the basis of stock is made to account for any reduction to a US shareholder’s Sec. 965(a) inclusion under Sec. 965(b), even though the E&P not included in income is treated as PTI (Sec. 965(b) PTI).[2]

After Sec. 965 (no basis adjustment election):

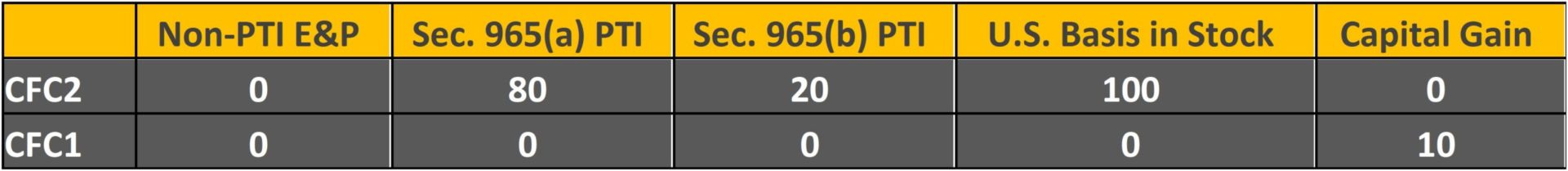

If US attempts to repatriate 100 from CFC2 in 2018, the result is 20 of capital gain (100 distribution less 80 of basis) corresponding with the 20 of “trapped” PTI allocated from CFC1 for which US did not have basis in CFC2 stock.[3] The gain reduction rule of Prop. Reg. 1.965-2(g) produces a similar result if the distribution is made in 2017.[4]

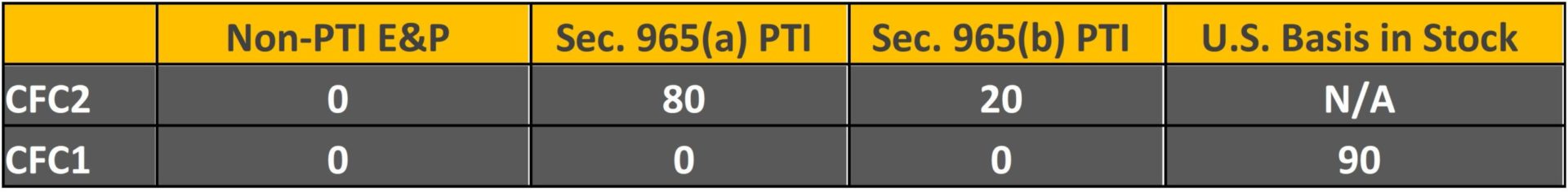

An election is available to be made on the 2017 return which increases US’s basis in CFC2 stock by the Sec. 965(b) deficit taken into account and reduces US’s basis in CFC1 stock accordingly. Note that the election applies to the entire amount of any allocated deficits and may therefore produce immediate capital gain in 2017 to the extent that the reduction in basis exceeds US’s basis in CFC1 stock (i.e. “negative” basis). A triggering event, such as an actual distribution out of Sec. 965 PTI, is not required for capital gain to be realized. The election must be made by the U.S. shareholder and all related persons (within the meaning of Sec. 267(b) or 707(b)) and applies to all specified foreign corporations (SFCs).[5]

After Sec. 965 (with election):

With the election, US will recognize no further capital gain if it receives a distribution of 100 from CFC2 in 2018.

If instead of a brother-sister relationship, CFC1 owns CFC2, the results are as follows:

After 965, Parent-Subsidiary (no election):

In this case, making the basis adjustment election has no effect, as the increase in US’s basis in CFC1 stock under Prop. Reg. § 1.965-2(f)(2)(ii)(A) is offset by the decrease under subclause (B). The two adjustments are netted together into a single adjustment.[6]

From an APB 23 perspective, note that the reallocation of basis under the election will create book-tax basis differences and may result in the immediate recognition of tax expense to the extent of the decrease in an entity’s basis.

Updates on 965 Elections and Statements

The proposed regs did not significantly expand on the guidance in the notices and the IRS’s 965 Q&A regarding the presentation of 965-related items on the 2017 return. The regs did however provide for some additional elections and gave some details on documenting aggregate foreign cash position. No relief is permitted under Sec. 301.9100-2 or 301.9100-3 to allow late filing of these elections or statements past the due date (with extension) for the 2017 return.

As described above, an election is available to make Sec. 965(b) basis adjustments. The election statement simply provides the U.S. shareholder’s name and taxpayer identification number and states that the U.S. shareholder and all related persons make the election.[7]

In case a U.S. shareholder has aggregate E&P deficits exceeding its aggregate deferred foreign income, Sec. 965(b)(3)(A)(ii) requires that the shareholder specify how much of each deficit corporation’s E&P deficit is actually to be used. The U.S. shareholder does this by completing a statement, to be maintained in the shareholder’s records and provided to each deficit corporation, describing:

(1) The portion of the shareholder’s pro rata share of the specified E&P deficit of the E&P deficit foreign corporation taken into account under section 965(b); and

(2) In the case of a deficit corporation that has a qualified deficit, the portion (if any) of the shareholder’s pro rata share of the specified E&P deficit of the E&P deficit foreign corporation taken into account that is attributable to a qualified deficit, including the qualified activities to which such portion is attributable.[8]

Finally, if any accounts receivable, actively traded property, or short-term obligations are included in the cash position of two SFCs, the U.S. shareholder can correct the double-counting on a statement describing:

(1) A description of the asset that would be taken into account with respect to both SFCs

(2) The amount by which the shareholder’s pro rata share of the cash position of the first SFC is reduced,

(3) A detailed explanation of why there would otherwise be double-counting, including the computation of the amount taken into account with respect to the other SFC, and

(4) For obligations between SFCs, an explanation of why the amount was not already disregarded under the rule of Prop. Reg. § 1.965-3(b)(1)[9]

The proposed regs did not provide any clarification with respect to the form or content of the statement required to rebut the presumption that certain transactions were undertaken with a “principle purpose of changing the amount of a Sec. 965 element.”[10] This is unfortunate, as the language in the regs is potentially broader in application than the language used in Notice 2018-26, § 3.04, which only applied the anti-avoidance rules to transactions “reducing the section 965 tax liability” of a U.S. shareholder.

Sec. 965 reporting cannot be filed late

As we rapidly approach the due date for 2017 returns of calendar-year corporate taxpayers, please do not hesitate to reach out to us if you have any questions or concerns on your Sec. 965 toll tax calculation or filing obligations. We emphasize again that the various Sec. 965 statements and elections described here and in our previous post on Sec. 965 reporting cannot be filed late, so make sure that you understand all of the implications of the Sec. 965 proposed regs for your company.

We hope this post was helpful as you assess the impact of tax reform on your business. GTM will be publishing regular posts highlighting key features and developments of tax reform. Visit our tax reform page for the latest U. S. tax reform updates.

[1] Prop. Reg. § 1.965-2(d)

[2] Prop. Reg. § 1.965-2(f)(1)

[3] IRC § 961(b)(2)

[4] Prop. Reg. 1.965-2(h)(3)

[5] Prop. Reg. § 1.965-2(f)(2)

[6] Prop. Reg. § 1.965-2(h)(2)

[7] Prop. Reg. § 1.965-2(f)(2)(iii)(B)

[8] Prop. Reg. § 1.965-2(c)(2)(ii)(B)

[9] Prop. Reg. § 1.965-3(b)(2)

[10] Prop. Reg. § 1.965-4(b)(2)(i)