When the Tax Cuts and Jobs Act passed in 2017, changes were made to the tax treatment of Research and Development (“R&D”) costs codified in IRC Section 174. These changes have drawn attention recently because they apply to tax years starting on or after January 1, 2022. While we still hope that legislation will be passed before the end of the year to rescind or delay the changes, for now they are law, and we must work with them.

Changes to IRC Section 174

The most impactful of the changes is the removal of the option to deduct R&D costs in the year incurred. Until 2022, taxpayers had the option to either deduct or amortize their R&D expenses. Taxpayers must now amortize R&D costs over five years for domestic R&D, or 15 years for foreign R&D. On its surface, this change appears to be timing – a benefit spread over multiple years or taken immediately in the current year. However, the impact on overall tax position can be significant and unexpected.

Taxpayers who have significant R&D costs and have net operating losses (“NOLs”,) for example, may believe that their cash tax horizon may be several years out. Up until now, they have been able to balance their NOL carryforwards and R&D deduction to remain outside of federal tax paying status. With the Section 174 change, their careful tax planning may be out of balance.

Take a high-tech company (“HTC”) with the following fact pattern:

- $75M taxable revenue in 2022

- NOLs coming into 2022 of $25M

- R&D costs in 2022 $50M, made up of $20M domestic R&D, and $30M foreign R&D

- Corporate tax rate of 21% for simplicity

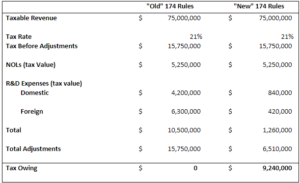

The following – greatly simplified – table summarizes the impact of the change for HTC:

* Simplified examples assumes NOLs are pre-2018 carryforwards not subject to 80% limitation, and amortization is the full year value (20% domestic, 6.7% international) rather than first year 50% value (10% domestic, 13.3% international).

Under the old rules, HTC managed their R&D investment and tax position wisely and does not owe federal tax. The value of the $50M in R&D expenses is deducted in its entirety ($50M x 21% = $10.5M). This deduction, combined with the value of the NOLs reduces the tax owing to $0 ($15.75M – $5.25M – $10.5M). Under the new rules, the outcome is significantly different. The current-year value of the R&D expense is significantly reduced from $10.5M in the original scenario to about $1.3M ($20M/5 x 21% + $30M/15 x 21%) under the new rules. The net result for HTC is a tax bill over $9M that if not planned for, is a very unpleasant surprise.

Although out of the scope of this article, there may also be major tax impacts coming from other areas of tax like foreign tax credits, GILTI, and more.

Mitigate the Impact with R&D Tax Credits

Some taxpayers in HTC’s position may have chosen not to calculate R&D credits in the past because they did not see the value in the exercise. They did not owe tax, and R&D tax credits do not help if you do not owe tax. Since NOLs are used before credits, a similar assessment is done by many taxpayers with large NOLs that are slowly being used. Under the new rules, however, the significant reduction in the value of R&D costs as a way to reduce taxable income, means that R&D tax credits become essential.

Another interesting twist on the “should I claim R&D credits now” or “should I wait to claim R&D tax credits” question is the potential impact of Chief Counsel Advice Memorandum 20214101F (“CCA Memo”). As described on our prior blog, the CCA Memo introduces a whole host of requirements for amended returns for refund and potentially jeopardizes other non-R&D tax credit refund claims.

Since the process to claim R&D tax credits can be time consuming, there are some taxpayers that only go through a detailed study once every few years. The idea being they can save time and money since collecting the required information for one year is not that different from collecting it for several years at once. You speak with the same people and get the same reports. Often, they wait until they have exhausted their NOLs to claim many years at once, or they plan to amend returns for the years between studies. The CCA Memo requirements make claiming credits on original returns much more important. The new Section 174 rules mean that taxpayers who believe they have time before they use their NOLs really need to be sure. Amending a return for an R&D tax credit refund is not the simple process it once was.

The new Section 174 rules will be a rude awakening for many taxpayers. The tax horizon that was thought to be years away, may be much closer than you think. It is essential to assess the tax impact of the new Section 174 rules, mitigate with R&D tax credits, and avoid filing amended returns for refund due to R&D tax credits.

To learn more about GTM’s R&D Tax Credit services or to speak with someone who can guide you through the process, contact us.