Author, Kaitlin Cooperstein, Supervising Senior Tax Analyst,

featuring an interview with Raymond Wynman, Director, International Tax

Tax software should create ease in managing your day-to-day tax processes and your quarterly and annual obligations. Corptax, for example, provides such tax solutions as Entity Management and Corporate Tax Compliance to track and analyze data and automate processes.

Your output from the software, however, is only as good as the time you put into your input. If you do not invest the time to enter the right data at the beginning of the process, you take the risk of inaccurate output, spending time to correct it and the loss of automation. Thinking through the data, and performing the right data entry by beginning with the end in mind, will save you issues later.

What Corptax International Can Do For You (once you’ve done your part for it)

Corptax International compliance completes calculations (e.g. Subpart F income inclusions, expense allocation and apportionment, foreign tax credit limitation calculations) for the preparation of international and domestic compliance. While the software is built with the technical knowledge to prepare the calculations, it relies on your organizational knowledge to analyze the data your company needs.

While the initial time needed to set up the basic data structure within Corptax will vary from organization to organization, the benefits and future successes will hold strong across the board.

Minimize Manual Tasks, Maximize the Value of Data Automation

Preparation and proper execution of the software minimizes time spent on repetitive tasks and maximizes time spent analyzing data and planning for future success.

One time-consuming task in compliance is manual entry of informational inputs. Names, addresses, owner and ownership percentages are all inputs that can flow directly, year after year, from the organizational data stored in Corptax. Making the initial time investment and providing routine maintenance will eliminate the need for manual entry in subsequent years and reduce the time needed to prepare the return. This, in turn, will increase productivity, create process efficiencies and narrow the margin for human error when making individual overrides in the system.

Let’s take international tax calculations, for example. Consolidated domestic compliance is often incomplete without consideration of foreign income inclusions and informational filings related to foreign entities owned. Seeing the international setup through from start to finish allows the domestic and international modules to talk to each other and provide the necessary information from income inclusions to foreign tax credits used.

Running the Corptax International calculation allows the historical information to carry over with the entities from year to year. Earnings, profits and tax pools do not function in a vacuum and are dependent on the organizational chart, intercompany transaction, historical data and much more. Maintenance of these items in the system will offer easy access to the full picture. A common database ensures the latest information across the system for all users. Conversely, using the software like a typewriter means the historical data will be tracked separately and negates the benefit of a single, centralized database.

Real-World Scenario: Preparation is Key to Successful Corptax International Setup

Raymond Wynman, Global Tax Management’s international tax director, provides a scenario below to show the importance of investing time into the setup of Corptax International.

When loaded with the right organizational data and with the proper execution, the software will assist you with the following:

- Look-through under Section 904, including the netting of circular look-through payments under 1.904-5(k)(2)

- Apportionment of expenses at the controlled foreign corporation level

- Ability to add category of income and account filters, plus expense factor adjustments, to construct complex apportionment bases

- Preparation of Section 956 inclusion calculations

- Preparation of Subpart F inclusion calculations

- Application of ordering rules with respect to the following activities:

- Subpart F

- Dividends

- Section 956

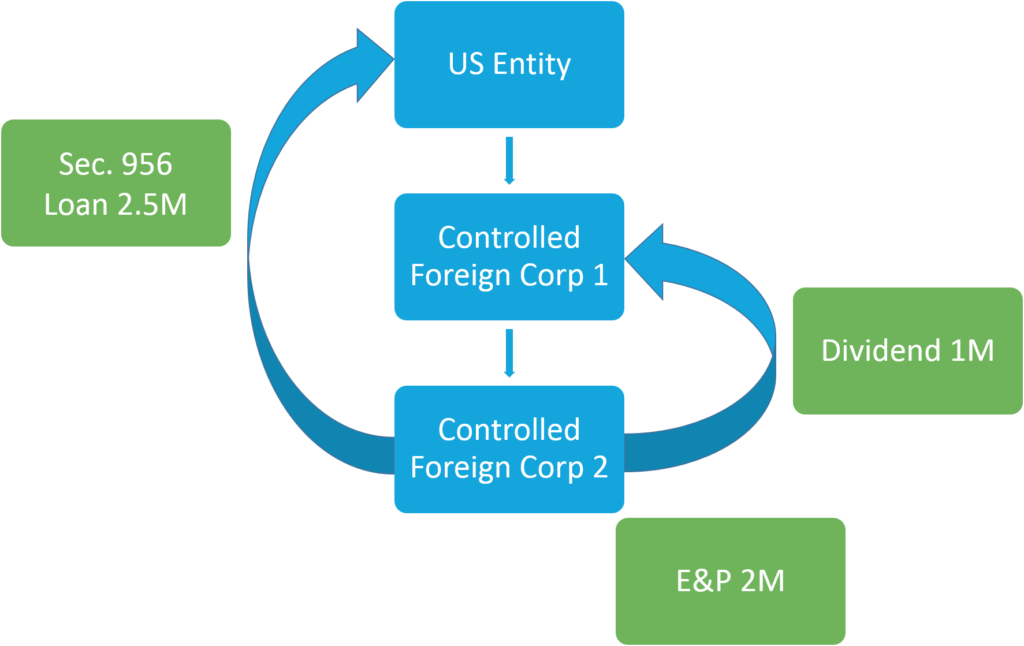

Let’s take the example below. US wholly owns Controlled Foreign Corporation (CFC) 1, which wholly owns CFC 2. CFC 2 makes a dividend to CFC 1 and CFC 2 make a loan to the US which constitutes investment in US property under Section 956. CFC 2 also has Subpart F income of $1M. Assume the numbers below for purposes of the example.

Example: US wholly owns Controlled Foreign Corporation (CFC) 1, which wholly owns CFC 2

Let’s now assume two scenarios: 1) the software is used as a typewriter and the user knows about the ordering under Subpart F and Sec. 956, but does not know the interaction rules between the two; and 2), the software is used properly and all the intercompany transactions and organizational data has been input but the user is not familiar with the Subpart F and Sec. 956 rules as well as the ordering rules.

Under scenario 1, the user likely calculated a Sec. 956 inclusion of $1M after reducing the E&P from $2M to $1M and exempted the dividend from CFC 2 to CFC 1 from Subpart F income (i.e., total inclusion in the US tax return is $1M).

Under scenario 2, the user input the data correctly, but since he/she is not aware of the rules, he/she let the software do the work. In this case, the software is applying the rules and includes $1M under Sec. 956 and $1M under Subpart F. The software knows about the technical rule that the dividend from CFC 2 to CFC 1 is not subject to the Subpart F look-through rules since it reduces, in this case, a Sec. 956 inclusion, (i.e., total inclusion in the US tax return is $2M).

With the right background information, your software will be able to calculate the proper treatment of this scenario. “There is no way you can capture this if using Corptax as a typewriter,” says Wynman. “Preparing the foreign calculation manually may lead to inaccurate answers which may result in overstating or understating taxable income.”

Have Confidence in Your Data

Tax process automation leads to faster execution and reporting throughout the financial, tax, compliance and audit landscapes. Do your diligence and spend ample time planning on the right data input that will, in turn, give you confidence in the data you are outputting, make your tax department more efficient and helping your team work smarter, not harder.

Learn more about our International Tax Services

To learn more about Corptax International Compliance:

- Watch a webinar: http://go.corptax.com/international-compliance-webinar

- Read a case study: http://corptax.com/resources/case-studies/

- Request a demo: 866.689.9872

|Author, Kaitlin Cooperstein, Supervising Senior Tax Analyst,

featuring an interview with Raymond Wynman, Director, International Tax

Tax software should create ease in managing your day-to-day tax processes and your quarterly and annual obligations. Corptax, for example, provides such tax solutions as Entity Management and Corporate Tax Compliance to track and analyze data and automate processes.

Your output from the software, however, is only as good as the time you put into your input. If you do not invest the time to enter the right data at the beginning of the process, you take the risk of inaccurate output, spending time to correct it and the loss of automation. Thinking through the data, and performing the right data entry by beginning with the end in mind, will save you issues later.

What Corptax International Can Do For You (once you’ve done your part for it)

Corptax International compliance completes calculations (e.g. Subpart F income inclusions, expense allocation and apportionment, foreign tax credit limitation calculations) for the preparation of international and domestic compliance. While the software is built with the technical knowledge to prepare the calculations, it relies on your organizational knowledge to analyze the data your company needs.

While the initial time needed to set up the basic data structure within Corptax will vary from organization to organization, the benefits and future successes will hold strong across the board.

Minimize Manual Tasks, Maximize the Value of Data Automation

Preparation and proper execution of the software minimizes time spent on repetitive tasks and maximizes time spent analyzing data and planning for future success.

One time-consuming task in compliance is manual entry of informational inputs. Names, addresses, owner and ownership percentages are all inputs that can flow directly, year after year, from the organizational data stored in Corptax. Making the initial time investment and providing routine maintenance will eliminate the need for manual entry in subsequent years and reduce the time needed to prepare the return. This, in turn, will increase productivity, create process efficiencies and narrow the margin for human error when making individual overrides in the system.

Let’s take international tax calculations, for example. Consolidated domestic compliance is often incomplete without consideration of foreign income inclusions and informational filings related to foreign entities owned. Seeing the international setup through from start to finish allows the domestic and international modules to talk to each other and provide the necessary information from income inclusions to foreign tax credits used.

Running the Corptax International calculation allows the historical information to carry over with the entities from year to year. Earnings, profits and tax pools do not function in a vacuum and are dependent on the organizational chart, intercompany transaction, historical data and much more. Maintenance of these items in the system will offer easy access to the full picture. A common database ensures the latest information across the system for all users. Conversely, using the software like a typewriter means the historical data will be tracked separately and negates the benefit of a single, centralized database.

Real-World Scenario: Preparation is Key to Successful Corptax International Setup

Raymond Wynman, Global Tax Management’s international tax director, provides a scenario below to show the importance of investing time into the setup of Corptax International.

When loaded with the right organizational data and with the proper execution, the software will assist you with the following:

- Look-through under Section 904, including the netting of circular look-through payments under 1.904-5(k)(2)

- Apportionment of expenses at the controlled foreign corporation level

- Ability to add category of income and account filters, plus expense factor adjustments, to construct complex apportionment bases

- Preparation of Section 956 inclusion calculations

- Preparation of Subpart F inclusion calculations

- Application of ordering rules with respect to the following activities:

- Subpart F

- Dividends

- Section 956

Let’s take the example below. US wholly owns Controlled Foreign Corporation (CFC) 1, which wholly owns CFC 2. CFC 2 makes a dividend to CFC 1 and CFC 2 make a loan to the US which constitutes investment in US property under Section 956. CFC 2 also has Subpart F income of $1M. Assume the numbers below for purposes of the example.

Example: US wholly owns Controlled Foreign Corporation (CFC) 1, which wholly owns CFC 2

Let’s now assume two scenarios: 1) the software is used as a typewriter and the user knows about the ordering under Subpart F and Sec. 956, but does not know the interaction rules between the two; and 2), the software is used properly and all the intercompany transactions and organizational data has been input but the user is not familiar with the Subpart F and Sec. 956 rules as well as the ordering rules.

Under scenario 1, the user likely calculated a Sec. 956 inclusion of $1M after reducing the E&P from $2M to $1M and exempted the dividend from CFC 2 to CFC 1 from Subpart F income (i.e., total inclusion in the US tax return is $1M).

Under scenario 2, the user input the data correctly, but since he/she is not aware of the rules, he/she let the software do the work. In this case, the software is applying the rules and includes $1M under Sec. 956 and $1M under Subpart F. The software knows about the technical rule that the dividend from CFC 2 to CFC 1 is not subject to the Subpart F look-through rules since it reduces, in this case, a Sec. 956 inclusion, (i.e., total inclusion in the US tax return is $2M).

With the right background information, your software will be able to calculate the proper treatment of this scenario. “There is no way you can capture this if using Corptax as a typewriter,” says Wynman. “Preparing the foreign calculation manually may lead to inaccurate answers which may result in overstating or understating taxable income.”

Have Confidence in Your Data

Tax process automation leads to faster execution and reporting throughout the financial, tax, compliance and audit landscapes. Do your diligence and spend ample time planning on the right data input that will, in turn, give you confidence in the data you are outputting, make your tax department more efficient and helping your team work smarter, not harder.

Learn more about our International Tax Services

To learn more about Corptax International Compliance:

- Watch a webinar: http://go.corptax.com/international-compliance-webinar

- Read a case study: http://corptax.com/resources/case-studies/

- Request a demo: 866.689.9872