By Jim Ford, Managing Director, SALT, Sales & Use Tax Compliance, and David Hillegass, Senior Manager, SALT

An Enterprise Resource Planning (ERP) system is a suite of integrated software applications utilized by both growing and established companies to manage the business and automate numerous back office functions related to technology, services, financials, and human resources. Popular ERP systems include JD Edwards, Microsoft Dynamics, NetSuite, Oracle, Sage, and SAP. The central feature of an ERP system is that it allows a company to collect, store, access, and interpret data across the company’s many business functions. In this regard, an ERP system can be highly effective. However, as you may have already found, this is not the case for the Tax Department, especially with regard to accurately and efficiently calculating tax depreciation. Luckily, there is an alternative.

Why Not Your ERP?

Prior to any discussion about a solution, it is important to identify the problem. The problem here is that ERP systems may not be the appropriate tool, and are being forced onto the Tax Department. Why is it being forced onto the Tax Department? Because a significant amount of effort and money goes into an ERP system and it is utilized by the Accounting/Finance Department to support the GAAP books.

At first glance, an ERP system may seem to be the appropriate tool for complex tax depreciation calculations that require a significant amount of data and processing because it is integrated throughout a company’s system architecture. If you look beyond the architecture and consider the points below, you will find several roadblocks when attempting to use an ERP for tax depreciation:

- Timing (Book vs. Tax) – For financial reporting purposes, GAAP books close on a monthly basis and the year-end close is normally within weeks after the end of the fiscal year. But tax returns are not typically filed until 8-9 months after year-end, and fixed assets and fixed asset transactions from a tax perspective will likely not be reviewed concurrently with the Accounting/Finance Department. That said, the Tax Department may require changes to fixed assets that were entered into the system up to 21 months prior due to cost adjustments or retroactive tax law changes. If these asset have already been closed by Accounting/Finance, it may prove difficult to affect changes in the ERP system.

- IT Support – Whether in-house or out-sourced, the ERP system has been implemented and is maintained by the IT function. The Tax Department is too frequently left “without a seat at the table” in the decision making process – specifically with regard to implementation and the ongoing maintenance. Therefore, certain tax requirements do not make it into the ERP system. In addition, as businesses have become more dependent on technology, the IT function has become significantly more strained, making it difficult (if not impossible) to obtain time and budget from IT for remediation of a tax problem.

- Differing Tax Treatment (Book vs. Tax) – The Accounting/Finance Department typically controls the fixed asset module within the ERP system. The challenge here is that Accounting/Finance are likely only knowledgeable in and concerned with keeping the GAAP books complete and accurate. Often, book and tax differ in the methodology used for depreciation, cost basis calculations, financing transactions, and intercompany transfers.

- Unmarried Data (Book vs. Tax) – Due to the differences in how fixed assets for book and tax are maintained, the records for each are commonly kept separate with little to no linkage between the two. In order to fully utilize an automated system, it is best practice to keep book and tax married. The marriage of the two records become almost insurmountable though, because book and tax frequently differ in their treatment of placed in service dates, disposals, depreciation methodology, and cost basis.

- Alternative Books (Book vs. Tax) – GAAP only requires the maintenance of a single book for fixed assets; whereas, tax may require the maintenance of numerous books (e.g. Federal, AMT, ACE, E&P, State, etc.). With these multiple tax books also comes the necessity for reporting. As the ERP system is controlled by IT and the company as a whole, it may be very difficult to get approval for, and subsequently maintain and report on, numerous tax books.

If Not ERP, then What?

So you now see that utilizing an ERP system for complex and automated tax depreciation calculations comes with many drawbacks. As a result, Tax Departments frequently derive their depreciation figures from a combination of the ERP system and an external source, like Microsoft Excel, to fill any gaps. Fortunately, numerous software solutions have been introduced to remedy this exact problem.

The software solutions available on the market today specifically target all of the issues outlined above by putting control in the hands of the Tax Department and by automating the entire depreciation process. Specifically, each of these software solutions provide the following benefits to the tax department:

- Freedom from the reliance on IT or Finance/Accounting for the structure or timing of its depreciation calculations.

- Ability to maintain numerous tax books, above and beyond the GAAP/Accounting book.

- Ability to make single or mass asset updates, including: tax life changes, disposals, additions, cost basis adjustments, etc.

- The tools necessary to perform automated tax depreciation calculation are all pre-loaded in the software solution. This includes things such as tax law updates, bonus depreciation intricacies, Section 179 rules, and all the different depreciation calculation methods.

- Ability to track location of assets, which could come in handy for both apportionment calculations and property tax reporting.

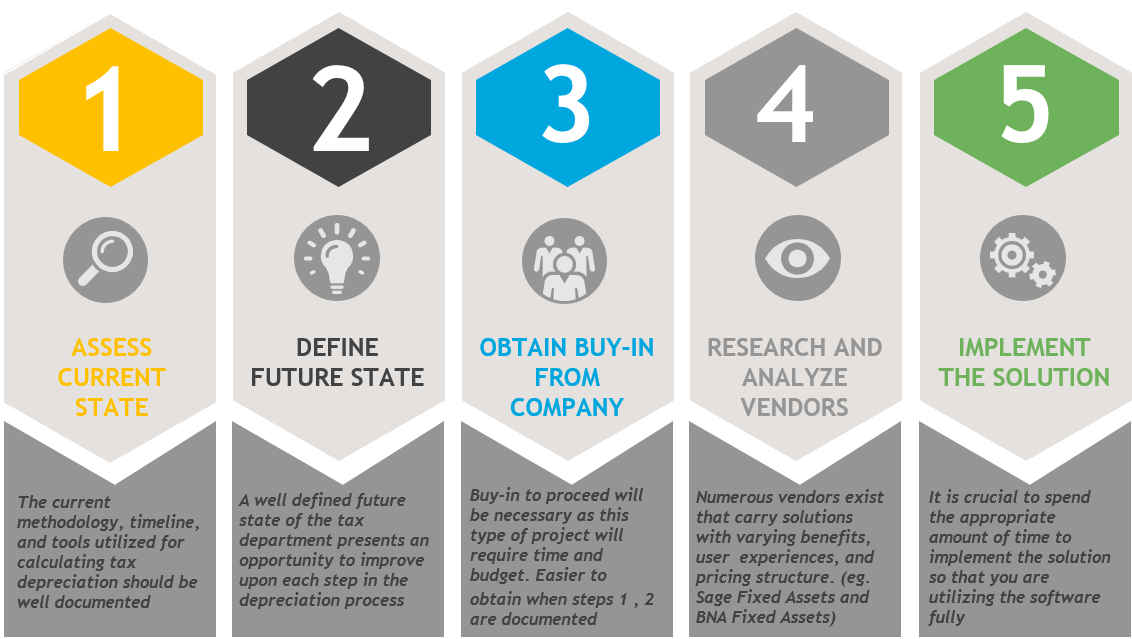

5 Steps to the Right Tax Depreciation Software Solution

A stand-alone software solution for tax depreciation, outside the current ERP environment, provides numerous benefits. Prior to entering into any decision, however, it is very important to perform the appropriate amount of due diligence. Here are the recommended steps in determining the correct solution:

If the above steps prove difficult to accomplish due to resource constraints or lack of expertise, it may be worthwhile to engage a consultant who specializes in these types of projects.

Conclusion

Technology has become an essential component of Tax Departments as they are forced to manage increasingly complex tax obligations. Many companies are facing increased challenges with fixed assets and depreciation calculations. Intricate rules and regulations around capitalization policies, the complexity of calculating tax depreciation, the volume of data necessary to maintain, and a constantly changing business environment make fixed asset accounting cumbersome.

The technology provided by the company to assist in this seemingly unmanageable task (i.e. the ERP system) often falls short of delivering the necessary capabilities in an efficient and timely manner. If any of the above article resonates with you and the difficulties you are seeing with your own tax depreciation process, then it may be time to look into utilizing technology developed specifically for this task.

To learn more or to speak with someone who can guide you through the process, contact Jim Ford or David Hillegass or read more here.