Webinar: Deploying a Tax Technology Strategy for the Modern Tax Department

In this one-hour webinar, GTM’s Anthony Sorrentino and Ron Shackelford will walk attendees through the process of deploying a tax technology strategy that empowers your…

Growing multinational companies juggle many tax responsibilities. Here are some tips for keeping all the balls in the air.

Internal resources may not be enough to cover all your tax needs. GTM’s co-sourcing solution is the strategic and cost-effective alternative for your tax department.

Looking to make a difference and grow professionally? GTM is 100% employee owned and actively looking for tax talent at all levels to grow with us. Interested?

Quick Links:

Repeatable, rapid, reliable. The data processing power of Alteryx data analytics software, combined with GTM’s industry-leading team of tax technology experts, is helping multinational tax departments across all industries save valuable time by creating repeatable and automated workflows that:

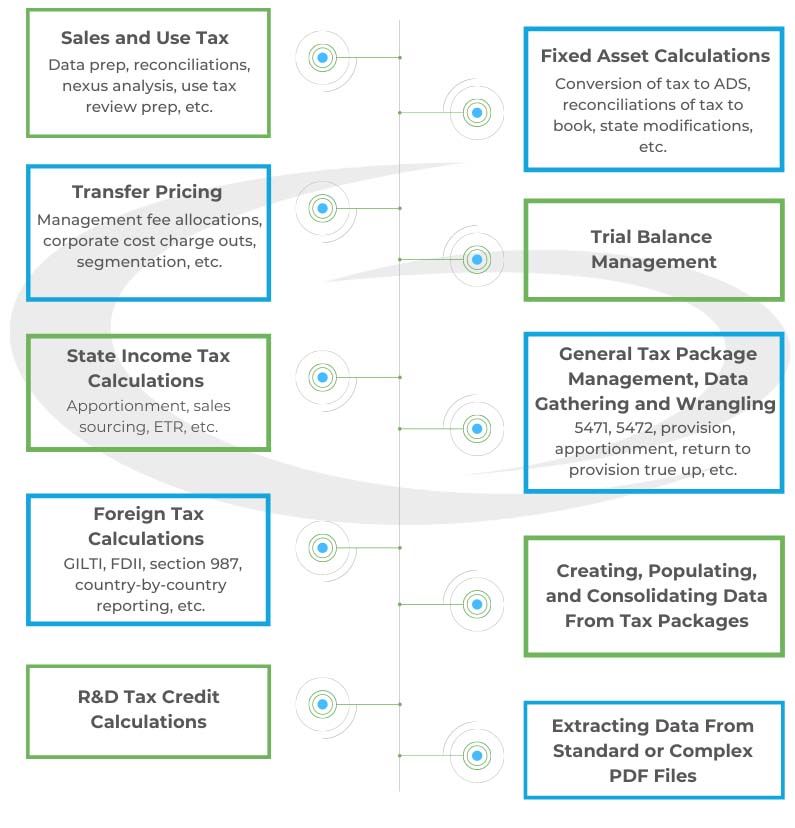

Broad Applicability with High Return

Alteryx can be applied across your entire tax department, from general use to Federal & State Income Tax; Indirect Tax; Transfer Pricing and International Tax; R&D Tax Credit; and more. For example, GTM used Alteryx to reduce manual processes by over 50% within our Sales and Use Tax department.

Ease of Use and Value

With Alteryx’s user-friendly interface and robust community, you can leverage your existing staff as citizen developers to achieve quick results. Alteryx is used to reduce wasted time manually manipulating or entering data for various tasks; mitigate risk associated with clunky and/or disconnected Excel files or Excel Macros; reduce dependencies on legacy systems that are no longer maintained and supported; and reduce errors associated with manual calculations.

Resource Maximization

When built right, Alteryx workflows require minimal maintenance and are easily reusable. Workflows integrate various data input sources and automate outputs, while supporting scheduling, error-checking, and enforcing data integrity. This allows resources in the department to spend more time on review, planning and other value-added exercises.

GTM helps you get the most out of Alteryx without it being burdensome, inefficient or a heavy lift for your department. We work collaboratively with you to come up with a plan that makes sense and helps you accelerate the time to value. Whether it is helping identify use cases, providing training sessions, guiding focused co-building workshops, leading development of workflows, or assisting in an on-call support capacity, we are flexible in meeting your needs. Our team of certified personnel helps accelerate the adoption of Alteryx within your tax department so you can reap the benefits sooner rather than later.

Ultimately, as technology consultants for corporate tax departments, our end goal is always the same – enablement. We enable you with the know-how and/or a solution that provides tangible value to your tax department.Contact us to help get you started on the journey to build a modern, technology-enabled tax department.

In this one-hour webinar, GTM’s Anthony Sorrentino and Ron Shackelford will walk attendees through the process of deploying a tax technology strategy that empowers your…

In this live, one-hour webinar, GTM’s Tax Automation Services team will provide a detailed look at how you can prepare for income tax compliance season…

In this live, one-hour webinar, Alteryx and GTM will introduce the concept of the tax technology stack, discuss how integration between various applications in the…

In this live, one-hour webinar, GTM’s Jim Ford and David Hillegass will take a high-level look at an approach that automates the sales and use…