30-Second Summary

- Tax Departments that license Corptax International are finding that CSC Corptax (Corptax) has made a number of updates to its software functionality

- New functionality includes modified software logic and calculations to adhere to the new rules released as part of the Tax Cuts and Jobs Act (TCJA,) as well as calculation modifications to comply with the increased data requirements set by the IRS

- This article shares practical tips and advice on how to improve your 2019 compliance process and reduce preparation time

As tax departments continue to navigate daily business needs during these unprecedented times, the filing of income tax returns is one need that remains constant – and due dates will arrive before we know it. Tax departments that license Corptax International are in luck, as CSC Corptax (Corptax) continues to make updates to the software functionality to ease the minds of tax directors as they begin to plan for 2019 income tax compliance.

Corptax has dramatically modified software logic and calculations to adhere to the new rules released as part of the Tax Cuts and Jobs Act (TCJA, or “Tax Reform”). Many calculation modifications have been made to comply with the increased data requirements set by the IRS.

Multinational businesses that utilize Corptax’s International module are starting to prepare the system for 2019 tax compliance. With the release of Corptax ® 2020.3, GTM has new guidance on enhancements to improve your 2019 compliance process by increasing efficiencies and reducing preparation time.

Automated International Compliance Forms

With the release of Corptax automated international forms, the population of Form 5471 has become more efficient and streamlined. Using the new calculations will turn a form-driven approach into a data-driven approach, meaning calculations will leverage existing data such as ownership and sourcing to populate forms automatically without the need for additional steps. This is possible because the updated software will pull data for these multiple uses by running the international calculations within the Corptax International module.

In order to use the automated international compliance forms, companies must license Corptax International and select the correct form calculation from the “Tax Return” window. The calculation used for Form 5471 is “Form5471_TY2019”.

But what happens if your team wishes to continue using the legacy process? This is fine, as the legacy forms are available for the 2019 compliance season. Corptax allows companies to use a combination of automated international compliance forms and legacy calculations simultaneously.

USD Ledger

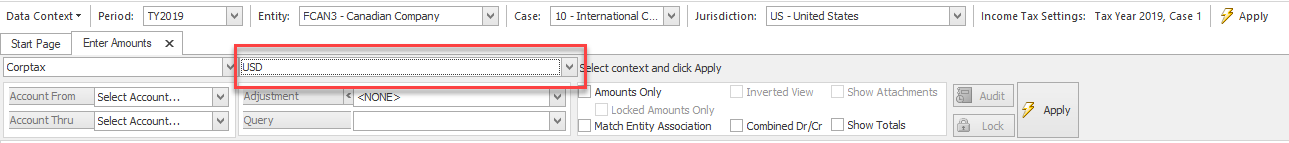

In order to prepare Form 5471, many companies would historically have imported both U.S. Dollar and Functional Currency ledgers into case 1 and case 10, respectively. Corptax 2020.2 includes the release of the “USD Ledger.” From a process standpoint, this means that preparers can group data under one case, bridging both USD and functional currency into their international compliance case, which is case 10 for most companies. The USD ledger can be accessed in the context window of the “Enter Amount” screen and by selecting the drop-down menu as shown below. This same ledger will be utilized when importing U.S. dollar trial balances into the software.

With the release of Corptax 2020.3, users have the ability to use the query function to easily copy and transfer data between ledgers on a more macro basis.

*click to expand the image in a new tab

Some companies may choose to bring in functional currency only, and make use of the Corptax exchange rates table to calculate U.S. dollar. These companies can continue using this process without interruption. Corptax will first look to the USD Ledger by entity; if there are no amounts in the USD Ledger, the system will populate USD Forms such as 5471 Schedule C, F and M by converting functional currency values to USD through the exchange rates entered in the software. With the release of 2020.3, detailed statements will be included within the Form 5471 calculation.

International Groups

Entities with large international organizational structures would have historically utilized “custom groups” to run consolidated forms. With the release of 2020.2, Corptax will now leverage the ownership and amount sourcing screen to accurately group the entities and baskets when reviewing a form with more than one entity or basket. The most common example is controlled foreign corporations (CFCs) with an ownership in a foreign disregarded entity. This is a time-saving upgrade, as users will no longer need to reconcile international calculations (based on ownership) to tax return forms (historically based on custom groups). The expectation is that this will cut down on system maintenance. Users must understand that keeping the system updated with an accurate ownership structure becomes even more important.

Corptax Web

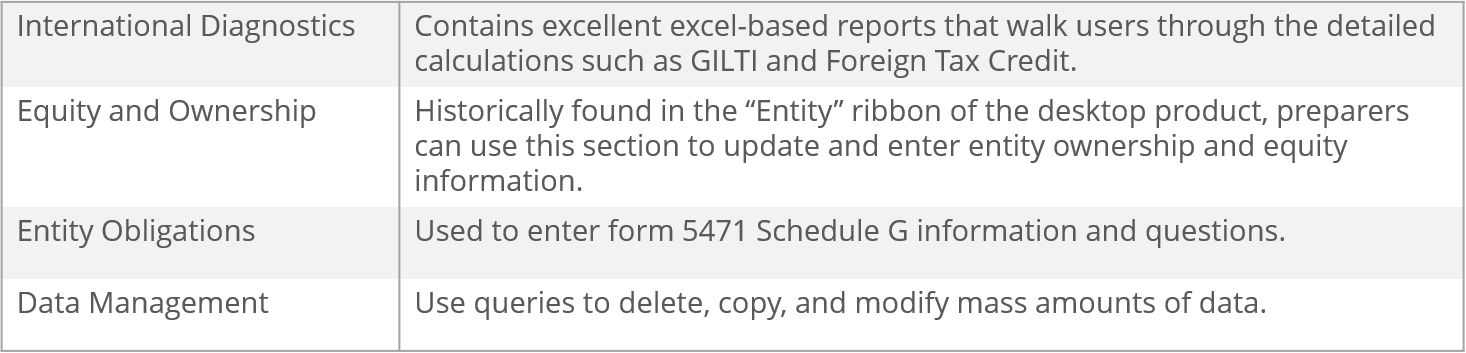

Certain functions can now be found on Corpax Web, which can be accessed through the Home ribbon of the Corptax client application. Within Corptax Web, users can gain access to essential functions. Below are some examples of such Corptax client applications:

As the ever-changing tax function becomes more and more complex, one thing that is clear is that Corptax continues to cut down on the steps needed to get through international tax compliance. However, users must be sure to stay informed as new updates are released. Doing so will put tax departments in a strong position to get through this year’s compliance comfortably and without extra work.

Bringing It All Together

For more information about Corptax and how to improve your compliance process, please contact me at ADiGiuseppe@gtmtax.com. GTM has a team of skilled tax professionals certified in Corptax ready to help you get through a busy compliance season.

About GTM’s Tax Automation Services (TAS)

GTM’s industry-leading team are experts in implementing, enhancing, and maintaining tax technology for large, multinational organizations. We take a flexible, individualized approach, working side-by-side with you to address your specific challenges and implement value-added solutions in all tax functional areas. Our tax automation services focus on Corporate Tax Software Implementation & Enhancements; Data Management & Business Intelligence; Tax Collaboration Technologies; and Process Assessment & Automation.