True Lease or Not True Lease?

Here’s an Action Plan to Tackle the Question (or Questions) Around Adopting ASC 842 Adoption

By Jim Swanick

ASC 842 is the new lease accounting standard[1] published by the Financial Accounting Standards Board (FASB). It will replace the previous US GAAP leasing standard, ASC 840, which is almost 40 years old. For public companies, implementation of the standard began after December 15, 2018. Private companies will follow later this year on December 15, 2019.

Although there were no direct changes in tax law with respect to treatment of leases from a tax perspective, the recording of the new Right of Use (ROU) assets and lease liabilities in connection with the adoption of ASC 842 may have deferred tax consequences from an accounting for income taxes perspective under ASC 740.

In this blog, I cover the highlights of the new leasing standard under ASC 842 as a level set, but more importantly I provide a practical action plan for tackling the tax implications of ASC 842 adoption. This plan will give you an answer to the question(s), “true lease or not true lease”?

Highlights of ASC 842

Here are the important points to know about ASC 842:

- For lessees, both finance and operating leases will now be recorded in the statement of financial position as a right-of-use (ROU) asset, and a corresponding lease liability.

- From a P&L perspective, finance leases will be similar to the amortization of a loan agreement with front-loaded interest expense and amortization expense. Operating leases will be recorded on a straight-line basis as a lease expense.

- In determining if the lease is a finance lease or an operating lease for US GAAP purposes, the “bright-line” thresholds that existed under the former rules have been replaced with a more “principles-based” approach.

- For calendar year publicly traded companies, the new lease accounting standard is effective beginning in 2019, unless earlier adoption was elected. Thus, for many public companies, implementation may be substantially complete. Privately-held companies have an extra year to adopt, so they may be in the very early stages of implementation.

ASC 842 Action Plan for Tax

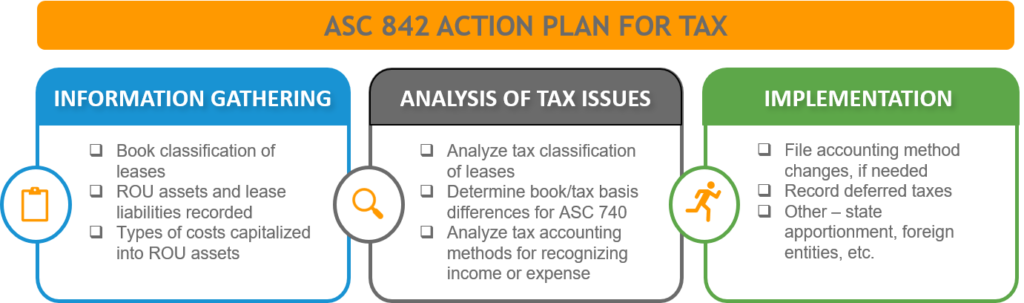

As I mentioned above, there is a practical way to act to address ASC 842 and other related tax issues. See below for the action plan.

- Information Gathering. From a tax standpoint, the key is coordination with the accounting implementation team. Ideally the tax team is part of the company-wide implementation team from the very start. If that is not the case, the tax team should, at the very least, thoroughly understand the information gathered and the adjustments being recorded by the accounting team. The tax team should have a good understanding of the following:

- The information gathered and analysis performed in determining the book classification of the leases (finance vs operating) to the extent the classification was re-assessed for book purposes.

- The amount of the ROU assets and lease liabilities being recorded, as well as how such amounts were determined (e.g., were any initial direct costs capitalized for book purposes, or were any prepaid or deferred rent balances included in the determination).

- Analysis of Tax Issues. Based on the information gathered in Phase One, the tax team should consider the resulting tax implications including the following:

- Confirm whether the lease is properly classified for tax purposes as a true lease or a non-tax lease (e.g., sales-type lease).

- Determine the book vs tax basis of the ROU assets and liabilities, as well as the differences in timing of rental income and expense.

- Assess whether the current methods of accounting for tax purposes related to the leases are appropriate considering the additional information gathered.

- Implementation. At this point, the Company has gathered and analyzed the available information and acts to record the various impacts of the new standard including:

- Record deferred taxes for any new basis differences primarily related to the new ROU assets and lease liabilities being recorded for operating leases.

- File applications for changes in accounting methods to the extent it is determined that certain leases were not classified correctly for tax purposes or certain other tax methods of accounting were not appropriate.

- Ensure that proper internal controls and processes are in place to handle the ongoing analysis of the tax implications as discussed above.

- Consider other potential issues (e.g., is there is an impact on the company’s state apportionment or property tax, have all foreign locations been properly addressed, etc.)

There’s A Method to the Madness

In closing, I would say that the task of addressing the tax implications can appear daunting at first. To put things in perspective, I reference a line from a famous bard, “Though this be madness, yet there is method in’t.”[2]

Follow the action plan. Once the information has been gathered and fully analyzed, and the issues have been narrowed down to a manageable few, tackling ASC 842 should become part of your normal routine. If you need additional information, reach out directly to me or check out the replay of the webinar I recently co-presented on the topic.

We hope this post was helpful as you assess the tax impact of ASC 842 on your business. GTM will be publishing regular posts highlighting new corporate tax developments as they are announced. Visit our tax & technology blog page for the latest.

[1] https://www.fasb.org/jsp/FASB/Page/SectionPage&cid=1176167771931

[2] Quote from William Shakespeare, Hamlet, Act 2, Scene 2, Page 9