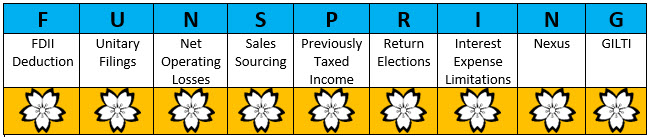

Prepare yourself for a “FUN SPRING” with our Top 9 things to consider during this SALT compliance season

By Chau Tran

Let’s face it, you rarely hear the word “fun” in the same sentence with state income tax compliance. This year is no exception, as the IRS has issued final and/or proposed regulations on almost all significant aspects of the new U.S. international tax regime, and states have been busy responding to tax reform by making significant changes to their own tax code.

In an attempt to bring some fun into the topic (or at least prepare you sufficiently so you have time to make some of your own fun this spring), use F•U•N S•P•R•I•N•G as a mnemonic device to remember the top 9 things to consider for a smooth state income tax compliance season when dealing with the impact of the Tax Cuts and Jobs Act of 2017 (“TCJA”):

F is for Foreign Derived Intangible Income (FDII) Deduction

FDII is a special deduction that presumably will be reported on line 29a of the federal form 1120. States that start with federal taxable income before net operating losses and special deductions, i.e., line 28, do not allow for such deduction. However, states that begin federal taxable income after special deductions, i.e., line 30, do allow for such deduction, absent a specific state modification to addback the deduction. It is critical to be informed of which states do and a do not conform to this new deduction.

U is for Unitary Filings

As of Q1 2019, there are 24+ states which have mandatory unitary filing requirements. While there are no new unitary states for the 2018 compliance season, Kentucky and New Jersey join the group in 2019 so the let tax planning begin, starting with how to handle overpayments from 2018 separate company returns.

N is for Net Operating Losses (NOL)

The new federal NOL limitations and carry forward/back changes do not impact many states. However, states that follow the federal limitation or have enacted similar NOL limitations include Delaware, Florida, Georgia, Kentucky, Maryland, Missouri, New Mexico, Rhode Island, Utah. Also, notable are state limitations irrespective of the federal limitations: Connecticut, Louisiana, Pennsylvania. This is often an area which is overlooked during quarterly estimate calculations and ultimately gets uncovered during compliance season.

S is for Sales Sourcing

Market-based or cost of performance? There are 24 states which now require the use of market-based sourcing for receipts from other than sales of tangible personal property (i.e. sales of services). We welcome Kentucky, Montana, and Oregon as new members into the “market-based sourcing club” starting this upcoming 2018 compliance season.

P is for Previously Taxed Income (PTI)

Are you bringing back PTI for federal income tax purposes this year? Not necessarily the case in states that did not conform to the TCJA. States that did not conform to the TCJA, most notably the transition tax (IRC 965), would not have included repatriation income on the 2017 tax return. Any PTI coming back in 2018 and subsequent years related to the repatriation income would not be considered PTI in the non-conforming states, so it is more important than ever to be aware of how these outliers are treating this inclusion.

R is for Return elections

Often overlooked, certain states allow elective filing positions to reduce compliance burdens and also to possibly reduce state tax liabilities. Are you filing 2 or more separate company returns in one state? Elective nexus consolidated returns offset income and loss companies and may also dilute apportionment which can be a “win-win-win” scenario for some filers!

I is for Interest expense limitations

Not all states conform to the IRC 163(j) interest expense limitations. In addition, separate company limitations are needed for separate company reporting states despite it being a consolidated concept at the federal level. Add pre-existing intercompany interest expense disallowance rules to the mix and the potential state modification calculation becomes interesting to say the least.

N is for Nexus

Physical presence. Economic nexus. Factor-presence test. What is next? You get the point.

G is for Global Intangible Low-Taxed Income (GILTI)

Is it Subpart F income or other income? The states don’t seem to agree among themselves. Some are treating it as deemed dividend (similar to Subpart F income) and allowing a dividend received deduction while others are taxing it as other income. State guidance will continue to be released up until filing deadlines (and even possibly after) to keep us all guessing and scrambling.

As an added bonus, let’s talk about depreciation! The TCJA has gifted taxpayers with provisions for the immediate expensing of capital expenditures, also known as 100% bonus depreciation. The concept of bonus depreciation is not a new one and neither are the challenges that come with it during state compliance season. However, our good friend “SALY” (same as last year) went on a permanent spring break because many states have changed how they are going to treat bonus depreciation going forward. We can no longer assume that if bonus depreciation was allowed or disallowed in past years (or worse – has its own unique state-specific calculation) that 2018 will be more of the same. Many states, such as Minnesota & Pennsylvania, have used the TCJA as a opportunity to update its pre-existing laws regarding everyone’s favorite topic of bonus depreciation.

I hope this post was helpful as you assess the impact of tax reform on your business and prepare for state income tax compliance season. GTM publishes regular posts highlighting key features and developments of tax reform and other tax related topics. Visit tax and technology blog page for the latest GTM point of view, and visit our income tax compliance page for more information.