By Raymond Wynman, Jim Swanick and Dan Mak

As President Donald Trump and the Republican-led Congress attempt to define a comprehensive tax reform package, details on policy changes are elusive. However, initial tax proposals released by the Trump Administration and House Republicans provide broad guidelines for what can be expected. As the saying goes, “it’s not the plan that’s important, it’s the planning” — so read on for what’s in the proposal, and a practical guide to preparing for tax reform.

Main proposals include:

- a reduction in the corporate tax rate from 35% to as low as 15%;

- a reduction in the pass-through business income tax rate from 39.6% to as low as 15%;

- repeal of certain corporate tax deductions and credits such as the Domestic Production Activities Deduction;

- expensing of manufacturing costs and capital investments in year one; and

- a one-time deemed repatriation charge from 3.5% to 10% on previously untaxed overseas corporate profits depending on proposal and type of assets; and

- potential for either a border tax or border adjusted tax system

- disallowance of deductions for net interest expense

In the interim, corporate tax departments can evaluate their tax planning strategies to maximize benefits under existing rules. While much commentary exists discussing the tax proposals, GTM seeks to assist corporate tax departments with the assessment of the tax impact of tax reform and determining additional tax planning needs.

What is Your Tax Department Doing to Prepare Now?

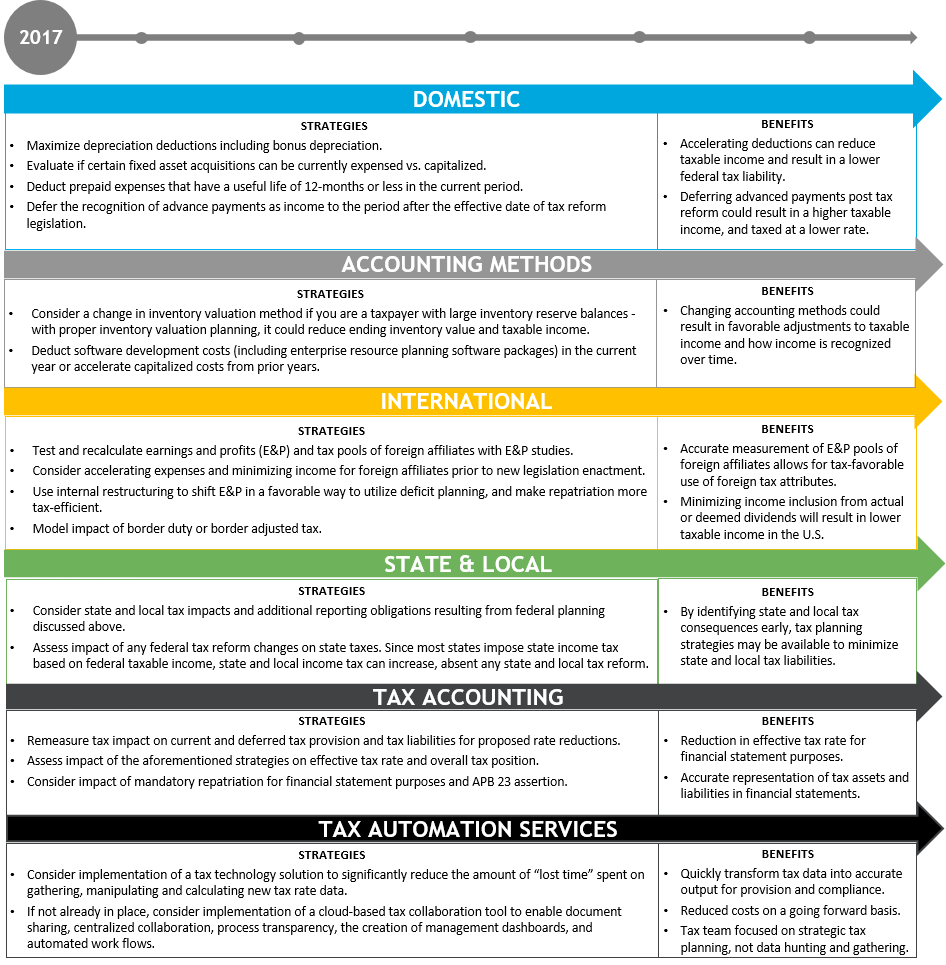

Is your tax department prepared for the potential tax changes under the Trump Administration and Congress? Here are some practical strategies U.S. companies should consider in light of potential legislative changes:

PRACTICAL STRATEGIES AND BENEFITS OF PLANNING FOR TAX REFORM

These strategies are some suggestions tax departments can use to maximize each U.S. company’s tax position, starting now. Whether you outsource the tax planning process or you are executing it in-house, you need a path forward.

Read more about our Tax Planning and Minimization Services

Read more about our International Tax Planning