“Our satisfaction with GTM goes well beyond our cash tax savings. Their specialized team took a big picture approach to our provision and compliance processes and asked “what if” questions along the way. They helped improve our processes, identify savings opportunities, and reduce our risk exposure. Having an outside firm who has our best interests in mind is invaluable.”

~ Carl Langren, CFO, NewLink

COMPANY

NewLink Genetics (“NewLink”) is a clinical-stage biopharmaceutical company focusing on developing novel oncology product candidates to improve the lives of patients with cancer.

SERVICES PROVIDED

- Full outsourcing of Tax Provision and Compliance

- Special Projects: State Tax Compliance Nexus Study and Apportionment Review

CHALLENGE

NewLink had historically relied on the Big 4 to assist with their tax reporting needs. Fundamentally, their compliance and provision processes were being performed in a straightforward manner each year. With significant NOLs and main operations in a single state, there were limited opportunities for tax savings in years when NewLink was a cash taxpayer. However, when faced with several challenges, they realized they needed a tax team with no independence issues who had the tax technical and technology-focused know-how of operational tax reporting who could support their tax processes.

SOLUTION

The key to identifying NewLink’s opportunity for tax savings was hiring tax experts that included director-level specialists on the front line asking the right questions, listening to answers, and taking a fresh look at NewLink’s filings and liabilities in real-time. By taking a deeper dive into their state taxes, GTM reviewed the Company’s state filing posture, including nexus-creating activities and receipts sourcing methodologies. Based on GTM’s knowledge of the industry, knowledge of the company, and state expertise, GTM identified opportunities and exposures leading to substantial tax savings and exposure mitigation. GTM’s analysis exceeded expectations by taking a holistic view across the provision AND compliance processes. This led to GTM providing position options which mitigated exposures and the discovery of other opportunities along the way.

RESULTS

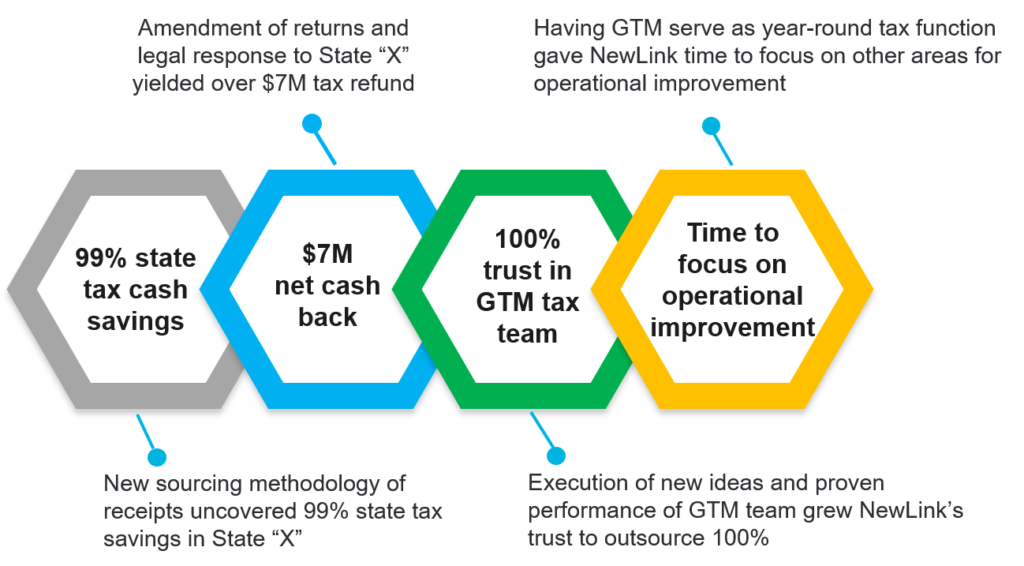

Saved 99% of State Cash Taxes in State “X”: During the provision review process, GTM identified an opportunity to source receipts differently, creating a solid position to amend income tax returns and ultimately request a 99% refund of the taxes paid in State “X”. State “X” reviewed the refund request and had questions which GTM addressed with the help of NewLink’s legal counsel. The State responded in less than one year from filing with an acceptance of the revised sourcing, resulting in a gross savings of approximately $7M.

100% trust in outsourced tax team: NewLink initially engaged GTM to secure specialized tax reporting expertise and improve the efficiency of their internal accounting department while mitigating risk. GTM exceeded these expectations — offering innovative ideas for the betterment of NewLink’s tax continuum. NewLink now relies on the GTM team year-round to serve as their tax function, handling tax issues beyond provision and compliance. This gives NewLink the ability to focus on other operational areas for improvement.