“In a time of transition, I relied on GTM to manage the due diligence and integration process with Quaker’s tax lead, and they delivered. Acting as our internal tax team, GTM identified many opportunities to reduce Houghton’s tax liabilities. They brought the stability and technical tax acumen I needed to meet the day-to day tax reporting and special project needs of a large multinational corporation.”

~ Keller Arnold CFO, Houghton International, Inc.

COMPANY

Global Houghton Ltd (“Houghton”) is a global leader in delivering advanced metalworking fluids and services. With headquarters in Valley Forge, PA, Houghton operates research, manufacturing and office locations in 33 countries around the world.

GROWTH STRATEGY

Houghton acquired Ohio based Wallover Enterprises in July 2016. In April 2017, Quaker Chemical Corporation (NYSE: KWR) and Houghton announced a definitive agreement to combine the companies. The transaction is expected to close by the end of 2017 or early 2018.

SERVICES PROVIDED

Houghton began outsourcing its sales and use tax compliance work to GTM in 2011. The relationship grew when Houghton called upon GTM for tax automation services to maximize its use of ONESOURCE™ Tax Provision and ONESOURCE Income Tax compliance software. When the department later needed experienced seniors to help during year-end close, GTM provided tax provision assistance. In March of 2016, the tax department underwent personnel changes and Houghton looked to GTM to provide a full outsource of the tax department. Currently, two GTM Directors, with domestic and international expertise, manage all tax department operations worldwide. Together with a team of GTM senior managers, supervisors, and seniors, the outsourced department prepares the quarterly tax provision, manages tax compliance, tax audits, BEPS and country-by-country reporting, and special projects including excess foreign tax credit planning. Most notably, GTM managed the due diligence process for the Quaker-Houghton combination.

CHALLENGE

Houghton’s tax department was in transition. They needed a stable presence to fill their tax resource gaps while delivering quarterly tax provisions, adhering to federal, state, and international compliance deadlines, generating tax savings through special projects, and supporting M&A.

SOLUTION

With a set monthly budget, GTM provided a core dependable team to Houghton with the flexibility to bring in additional specialists when needed. Each tax project was staffed with the right technical resource utilizing GTM’s federal, international, state, sales & use, and tax automation specialists. Having the ability to use specialists in every aspect of the department’s function created the ideal tax department, and allowed Houghton to realize significant business impacts while successfully accomplishing all tax reporting requirements.

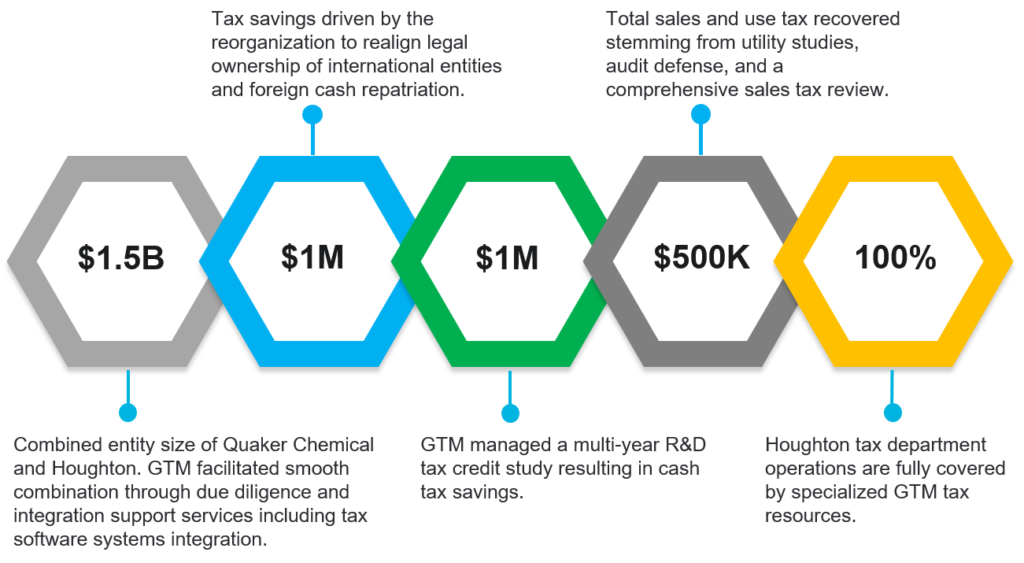

VALUE DELIVERED