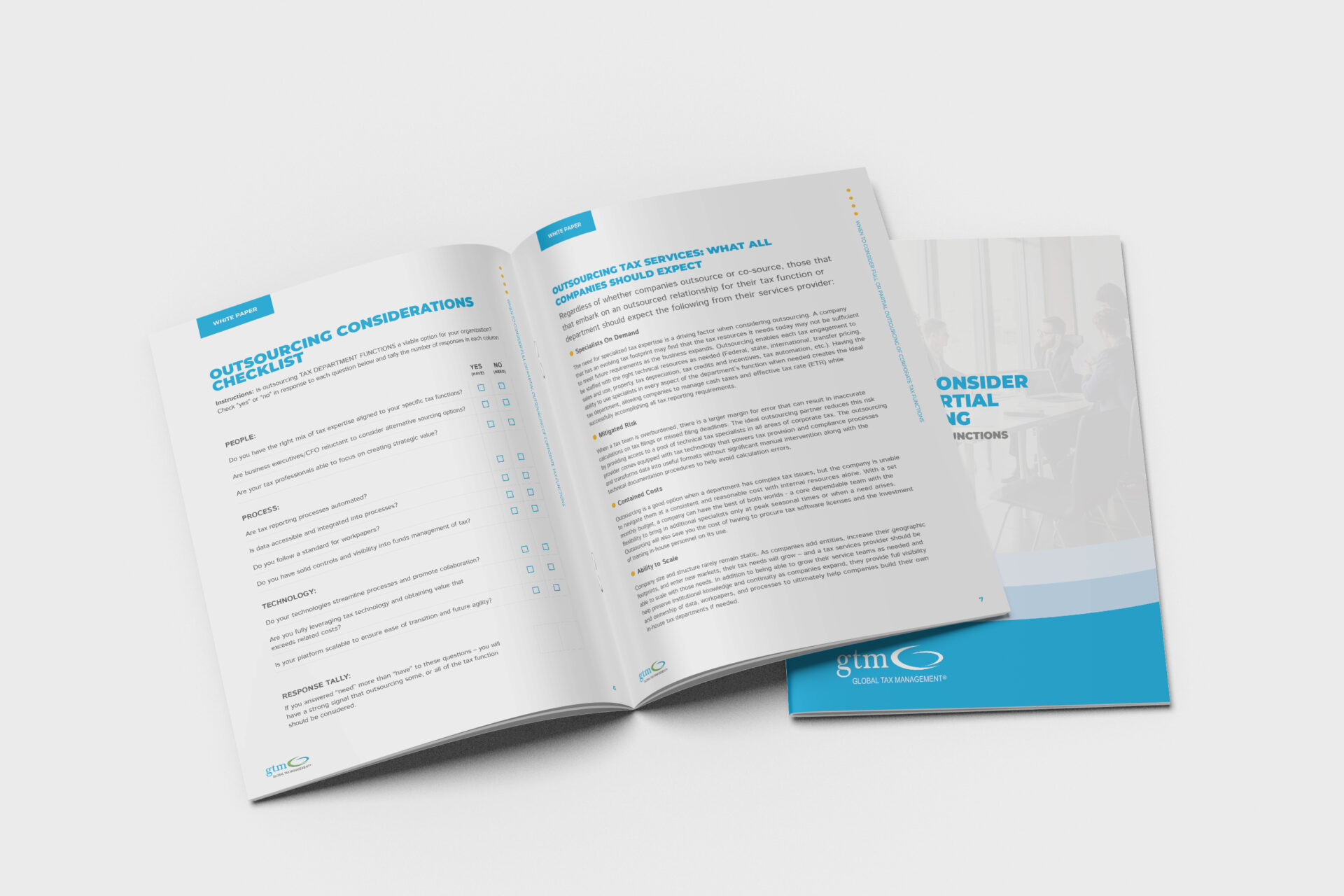

White Paper: When to Consider Full or Partial Outsourcing of Corporate Tax Functions

Companies of all sizes are driven to explore outsourcing their tax functions for a clear set of reasons. These include deadline pressures, budget limitations, stretched-thin internal resources, and challenges keeping up with regulatory changes. Outsourcing tax functions, whether fully or partially, offers companies access to the right people, process, and technology to comprehensively address operational tax functions and reduce overall tax liabilities for their organization.

This white paper compares the different outsourcing alternatives and lays out what all companies should expect when bringing in an outsourced tax provider. Is some form of outsourcing right for your tax environment? Run through the quick checklist included in the white paper to help you decide.