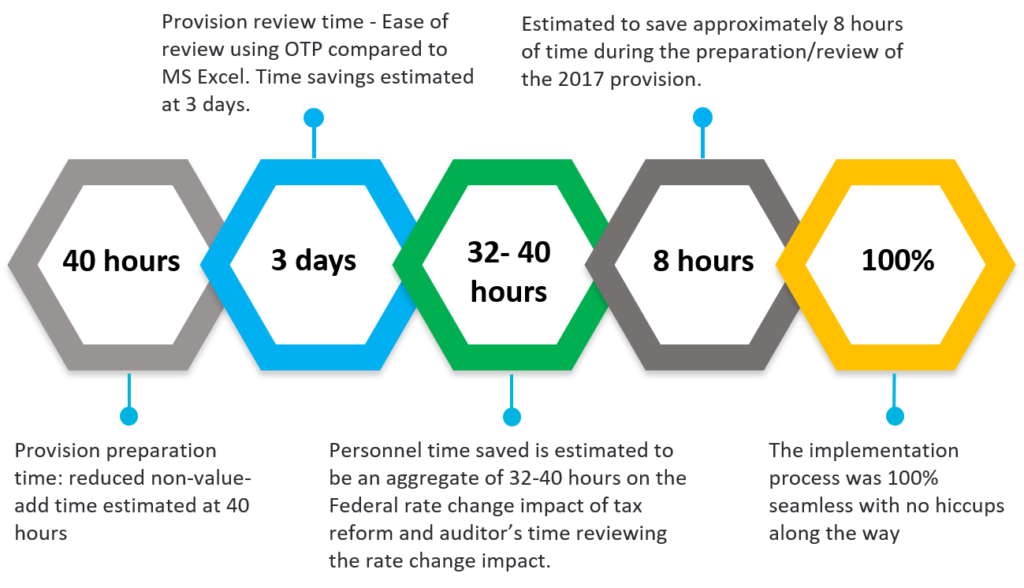

“Automating the provision process has saved Sonepar USA’s tax team upwards of 120 hours (in aggregate) for the 2017 tax-year alone. The GTM team facilitated a smooth transition from our manual Excel approach to take immediate advantage of ONESOURCE Tax Provision (OTP) software. Our new provision process has been recognized positively up to the senior finance executives, raising the visibility and value of our tax department’s contributions to the bottom line.”

~ Nick Vanderlyke, Senior Manager, Income Tax, Sonepar USA

COMPANY

Sonepar USA (“Sonepar”), headquartered in Paris, France, is an independent family-owned company with global market leadership in B-to-B distribution of electrical products and related services. Today, the Sonepar Group is represented by 167 operating companies spanning 44 countries on five continents. In the USA, Sonepar is represented by 15 locally managed electrical and industrial distributors with over 700 locations and coverage in all 50 states.

SERVICES PROVIDED

Corporate tax software

implementation and optimization

CHALLENGE

Sonepar’s small tax team has the challenge of completing the time sensitive recurring task of income tax provision preparation and review, coupled with an acquisition strategy that brings new entities into its portfolio on a regular basis. Its income tax department has approximately 2 1/2 weeks to complete the entire provision, including tax entries and tax footnotes, making it difficult to meet deadlines and concentrate on quality review and other tax deliverables. After spending too much time on rolling over and linking excel schedules and facing increased pressure from audit risk, Sonepar made the decision to break away from Excel and find an

automated solution that is more effective and efficient.

SOLUTION

After deciding on Thomson Reuters ONESOURCE Tax Provision (OTP) as the automation tool, Sonepar sought an implementation partner and collected repeated referrals for GTM from their peers. They engaged GTM to help lead and manage the OTP software implementation. GTM’s implementation plan included a phased approach for Integration, Journal Entry, Workpapers, Training and Documentation, Hard Close ‘Parallel’ Support, and Year-End 2017 ‘Go-Live’ Support. Effective implementation of OTP allowed Sonepar’s acquisitive business to scale without incurring more non-value add tax department time.

VALUE DELIVERED